When you envisioned what it would be like to work as a freelancer, you probably imagined days spent writing, coding, designing, or doing something else that you love. You certainly didn't daydream about scanning receipts, logging expenses, sending invoices, and filing your taxes. But those tasks are an inevitable part of working for yourself in every role and industry.

Doing your own bookkeeping doesn't have to be a time-consuming chore. The best accounting software for freelancers simplifies and expedites the tasks of logging and tracking your expenses, sending invoices, and filing your taxes at the end of the year. With the right tool, you can spend as little as an hour a month doing the accounting work for your business.

What Makes Great Accounting Software for Freelancers?

As the gig economy has grown, so have the number of options for self-employed accounting software. But not all apps are equal. We set out to discover the best among them, those that met the following criteria:

- Simple to use: A user-friendly interface makes accounting less of a chore—minimal clicks or taps to create an expense report, for example, and navigation that doesn't require multiple, lengthy video tutorials to accomplish the core purposes of the app.

- Core features for essential tasks: Selected apps focus on the bookkeeping tasks freelancers need to complete: invoicing, tracking payments, and logging deductible expenses.

- Beginner-friendly: Users need little-to-no knowledge of accounting and tax laws to take advantage of each app's features.

- Digitization: Each app provides a way to digitize receipts, save them, and record the expenses from your email, phone, or scanner.

After testing nearly 40 accounting and bookkeeping apps, we narrowed the list down to the following 11 tools.

The 11 Best Accounting Software for Freelancers

These 11 web and mobile apps make it faster and easier to do the unavoidable accounting and bookkeeping tasks that go hand-in-hand with working for yourself:

- QuickBooks Self-Employed (Web, iOS, Android) for freelancers who file their taxes using TurboTax

- FreshBooks (Web, iOS, Android) for freelancers with complex billing needs

- Wave (Web, iOS, Android) for freelancers who want free invoice tracking and bookkeeping

- FreeAgent (Web, iOS, Android) for freelancers who need a place to create, store, and track estimates

- Xero (Web, iOS, Android) for freelancers who need a highly customizable and scalable app

- Zoho Books (Web, iOS, Android, Windows) for freelancers who need more than a bookkeeping tool

- Expensify (Web, iOS, Android) for freelancers who only want a way to keep track of receipts

- SlickPie (Web) for freelancers who need to invoice in multiple currencies

- Shoeboxed (Web, iOS, Android) for freelancers who need simple receipt digitization

- ZipBooks (Web, iOS) for freelancers who may need professional accounting help

- AND CO (Web, macOS, Chrome, iOS, Android) for freelancers who need to manage both accounting and legal tasks

QuickBooks Self-Employed (Web, iOS, Android)

Best accounting software for freelancers who file their taxes using TurboTax

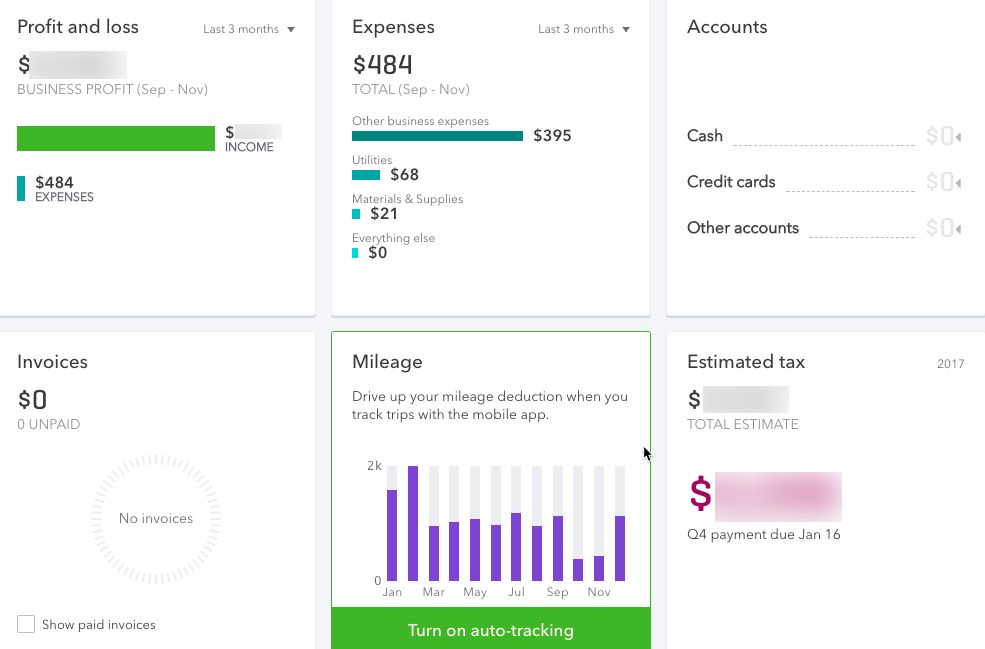

If you prefer to file your taxes on your own using TurboTax, QuickBooks Self-Employed will save you a lot of time when tax season rolls around. Since both TurboTax and QuickBooks are Intuit products, they're integrated. Automatically transferring data from QuickBooks into TurboTax when it's time to file taxes saves hours—or days—of manual calculations and data entry.

But even if you hire an accountant to prepare your taxes for you, QuickBooks Self-Employed is an excellent bookkeeping tool, particularly for tracking expenses and tax payments. Connect it to your business or personal bank and credit accounts to automatically capture all transactions. For freelancers in the U.S., QuickBooks also calculates how much you owe in federal taxes each quarter so you never overpay or underpay.

The QuickBooks mobile app provides even more features. If your business and personal accounts are combined, you can swipe left or right on the mobile app to tag expenses as either business or personal. And if you turn on automatic mileage tracking, the app records the number of miles traveled every time you drive. Then, categorize trips as business or personal later.

QuickBooks Self-Employed Price: $5/month for Self-Employed which includes expense tracking, invoicing, and mileage tracking; $10/month for the QuickBooks Online Simple Start plan that includes tips for maximizing tax deductions and sales/sales tax tracking.

Automate QuickBooks Online with QuickBooks' Zapier integrations.

FreshBooks (Web, iOS, Android)

Best accounting software for freelancers with complex billing needs

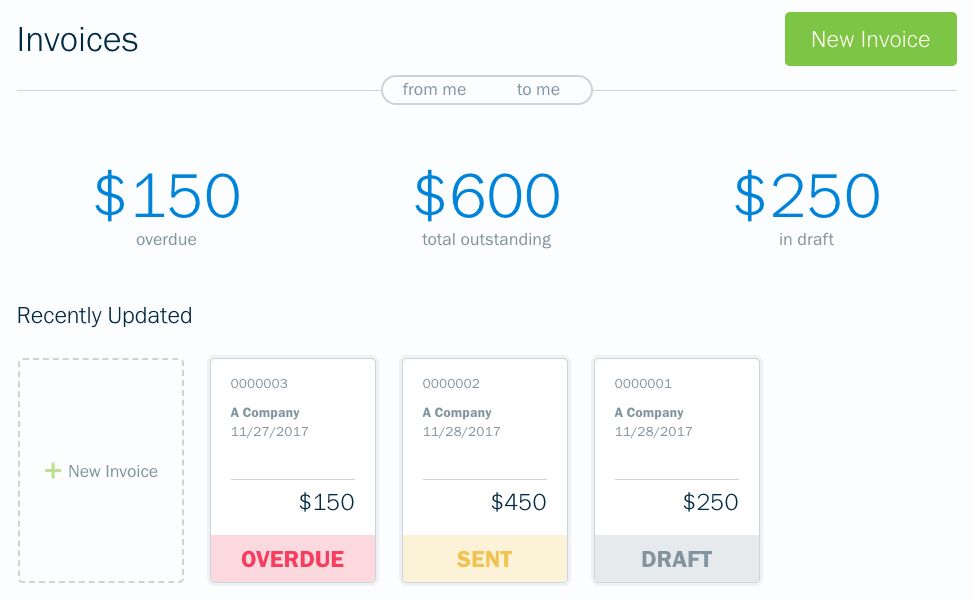

For some freelancers, billing is relatively simple: You agree on rates, and the client pays those rates each month. But for others, billing clients is much more complicated. Maybe you charge by the hour and keep track of billable time. Maybe you pay for things out of pocket and get reimbursed later. Or maybe you hire and pay other contractors.

If you have varying invoice needs, FreshBooks is designed for you. Within the system, you can set up multiple clients and multiple projects for each client. If you have clients that are notorious for paying late, you can set up automated payment reminders in FreshBooks that remind clients of upcoming and past-due invoices so you don't have to.

FreshBooks' lowest-cost plan covers nearly every use case for self-employed bookkeeping, letting you track time, record general business and billable expenses, send invoices, and collect payments. And if you upgrade to a mid-tier plan, you also get tools to help you send proposals, collaborate with an accountant, and charge late fees on overdue invoices.

FreshBooks Price: $15 per month for the Lite plan that includes unlimited invoicing and estimates for up to five clients; $25/month for the Plus plan that includes proposals, recurring invoices, automatic payment reminders, and late fees for up to 50 clients.

Automate FreshBooks with Zapier's FreshBooks Classic and Freshbooks New integrations.

Wave (Web, iOS, Android)

Best accounting software for freelancers who want free invoice tracking and bookkeeping

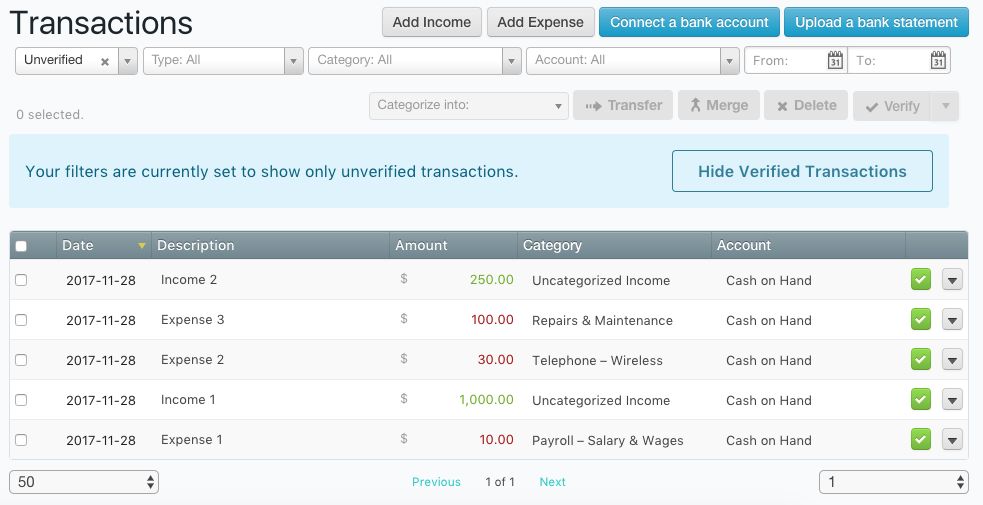

When you're starting out as a freelancer, you may not have a lot of excess cash to throw around. But even if you're not making much, you still need to keep track of your income and expenses. Wave is a free solution that provides all the tools you need to do your business accounting—from sending professional invoices (including recurring invoices) to receipt scanning on the mobile app and even payroll processing.

Like QuickBooks and FreshBooks, Wave connects directly to your bank or credit card accounts, pulling in all of your transactions so you can easily capture business expenses. You can also upload old bank statements to the system to get caught up on past expenses you failed to record. This makes Wave handy if you neglected to do your bookkeeping for part of the year.

And if you ever decide it's time to grow your business, Wave has the features you need to scale your accounting operations. It lets you add unlimited collaborators if you bring on someone to help with bookkeeping, run multiple businesses from a single account, and even manage payroll and payroll taxes.

Wave Price: Free for accounting, invoicing, and receipt scanning; from $20/month plus $4/employee or contractor for Payroll within the U.S.

Automate Wave with Wave's Zapier integrations.

FreeAgent (Web, iOS, Android)

Best accounting software for freelancers who need a place to create, store, and track estimates

If you create estimates for large projects as part of your business, FreeAgent may be the right accounting app for you. Directly within the tool, you can create and send project estimates to prospective clients. If those prospects become clients later, track future invoicing against those estimates to see which of your contracts are profitable and which aren't.

Additionally, including estimates as part of your bookkeeping records allows you to get a full picture of both your historical income and potential future profits. Quickly view both received and anticipated income on your FreeAgent dashboard to stay on top of the health of your freelancing business.

FreeAgent also has helpful bonus features like time tracking and invoicing. Use its built-in time-tracking tool to capture every second that you work on a project, then transfer that time to an invoice to bill clients quickly. And like some of the other apps on this list, invoicing can be set up to send automatic payment reminders that nudge late-paying clients.

FreeAgent Price: $12/month for the first six months; $24/month thereafter.

Automate FreeAgent with FreeAgent's Zapier integrations.

Xero (Web, iOS, Android)

Best accounting software for freelancers who need a highly customizable and scalable app

When you're starting out freelancing, you only need to send invoices and track expenses for a few clients. Eventually, you'll get a business bank account and want to track expenses separately—and perhaps will need to make custom documents for clients, track time spent on projects, and more.

Xero is an accounting app that can grow as you do. You can start out using it to send invoices, monitoring payments as they come in on Xero's dashboard. Then, you can connect it to your bank and payment services to manage all of your finances. Upgrade later if you hire team members and need to manage payroll from Xero as well.

If your accountant uses Xero, you can share your financial data with them directly. And if you need more tools over time, you can add a wide variety of integrations and extra features to extend your accounting app as your work grows. Xero integrates with more than 700 apps—like Shopify, PayPal, Stripe, and Gusto—through its app marketplace.

Xero Price: From $9/month for the Early plan that includes five invoices and quotes per month and reconciliation of up to 20 bank transactions.

Automate Xero with Xero's Zapier integrations.

Zoho Books (Web, iOS, Android, Windows)

Best accounting software for freelancers who need more than a bookkeeping tool

Zoho Books is a full-featured accounting app. It's designed for businesses, but it has all the features you need as a freelancer, too. Plus, Zoho's business focus might even help you speed up your work. Instead of having separate sections for your customers, tasks you're working on for them, expenses during the project, and invoices once the project is finished, Zoho Books organizes everything into a timesheet workflow.

Add new clients to Zoho Books, then list the projects you'll work on with them. You can then track time and expenses, send invoices, and manage everything about that client in one place.

But the best thing about Zoho Books is that it's part of Zoho's comprehensive suite of apps. If you need other tools to run your business—such as a CRM, email hosting provider, project management app, or inventory tracking tool—you can take advantage of Zoho's other apps to connect all of your business operations to your accounting workflow.

Zoho Books Price: $9/month for the Basic plan that includes two users, 50 contacts, and five automated workflows; $19/month for the Standard plan that includes three users, 10 automated workflows, and 500 contacts.

Automate Zoho Books with Zoho Books' Zapier integrations.

Expensify (Web, iOS, Android)

Best accounting software for freelancers who only want a way to keep track of receipts

If your accounting goal is just to have a way to keep track of your business receipts throughout the year so you can hand them off to your accountant during tax season, Expensify may be the best solution for you. Unlike the other apps on this list that offer more full-suite accounting solutions, Expensify focuses on a single goal: helping you keep track of your receipts.

With Expensify's mobile app, quickly capture clear images of receipts, and the app will automatically categorize expenses, parse the amounts and merchant names, and save all the transaction details to your Expensify account. Add entries for mileage and hours worked, if needed, to track all of your business expenses in a single view. And if you connect your credit card to Expensify, that's also an easy way to select expenses and turn them into emailable reports or PDF files.

Expensify is the simplest app on this list to use, but it doesn't have some of the options that will help if you're filing your taxes yourself—such as auto-calculations of quarterly taxes owed or categorizing expenses based on how you'll file them as deductions. However, if you plan to work with an accountant, Expensify probably has all the features you need.

Expensify Price: Free for expense tracking and up to five SmartScans of receipts each month; from $4.99/month for the Track and Submit plans that include unlimited SmartScans.

Automate Expensify with Expensify's Zapier integrations.

SlickPie (Web)

Best accounting software for freelancers who need to invoice in multiple currencies

SlickPie has a steeper learning curve than some of the other apps on this list, but taking time to learn how it works is worth it if you need to track expenses in various currencies. Use SlickPie to create invoices in any currency you need to bill in. Regardless of what currency you're paid with, your dashboard shows what you've earned in your default currency.

SlickPie also has a process for recording expenses from receipts, though it doesn't use a mobile app like the other products on this list. Instead, you take a picture of a receipt—or a saved PDF of a bill—and drop it into a dedicated Dropbox folder. SlickPie then processes the receipt data and adds it to the system for you.

SlickPie Price: Free for unlimited receipts, multi-currency invoicing, and up to 10 company accounts; from $19.95/month for the Pro plan that includes up to 50 company accounts and phone support.

Shoeboxed (Web, iOS, Android)

Best accounting software for freelancers who need simple receipt digitization

Shoeboxed is another great option for freelancers who want to hand off expenses and receipts to an accountant at the end of the year. Use it to digitize your business receipts in many different ways:

- Capture pictures of receipts on the go with the Shoeboxed mobile app.

- Forward email receipts to Shoeboxed.

- Set up auto-sync to have Shoeboxed automatically pull receipts from Gmail.

- Mail a pile of receipts to have them scanned and saved by Shoeboxed.

Because Shoeboxed offers so many different options for digitizing and saving receipts, you can record every business expense—regardless of how the receipt is delivered—within seconds. It's particularly helpful if you have boxes or file folders filled with business receipts but no time to scan them in and want to outsource that job to a service.

Shoeboxed Price: $29/month for the Startup plan that includes one prepaid envelope for sending paper receipts and 25 receipts (paper or digital) per month.

ZipBooks (Web, iOS)

Best accounting software for freelancers who may need professional accounting help

Like most of the apps on this list, ZipBooks lets you connect bank and credit card accounts, automatically pull transactions, and edit the details of those expenses. Use your phone to capture images of receipts, and upload them to ZipBooks using its iOS app. Finally, create and send one-off and recurring invoices.

But if you're really nervous about doing your own bookkeeping and want the certainty of knowing that a professional is there to help the moment you need it, ZipBooks is the tool for you. ZipBooks gives you the option to pass all of your accounting and bookkeeping off to a professional who can answer your questions and help you reconcile your bank accounts, find deductions, and prepare your taxes.

ZipBooks Price: Free for the Starter plan that includes unlimited invoicing and one connected bank account; from $125/month for the Simple Bookkeeping plan that includes professional bookkeeping services.

AND CO (Web, macOS, Chrome, iOS, Android)

Best accounting software for freelancers who need to manage both accounting and legal tasks

As far as accounting tasks go, AND CO has everything freelancers need. Connect your bank/credit accounts to record business expenses, track your time, create and send invoices, accept payments, and even see when clients have viewed invoices you sent. Forward email receipts or take a picture of physical receipts and upload them using AND CO's mobile app.

Where AND CO stands out is with its legal features. Protect yourself with AND CO's standard freelancing contracts, written by the Freelancers Union. Turn sections of the contract on and off as needed, and collect client signatures with e-signing functionality. And when clients don't pay, send a prewritten physical demand letter directly from the app.

AND CO Price: Free

Automate AND CO with ANDCO's Zapier integrations.

Stop Wasting Time and Start Automating Your Bookkeeping

Every hour you spend on bookkeeping, accounting, and tax-related tasks is an hour that you're not earning any income. As much as possible, you'll want to automate these tasks so you can focus on building your business and your profits. With Zapier's app automations (Zaps), you can build automated workflows that handle bookkeeping tasks so you don't have to.

Here are some examples:

- Add sales receipts from your payment processor to your bookkeeping app automatically:

- Automatically create a new contact in your accounting app when you add one to your CRM:

- Add new customers from your accounting software to your email marketing app:

Collecting receipts, sending invoices, logging and categorizing expenses, filing taxes: These are all inevitable parts of working for yourself. However, if you use the right app—one that makes it easy to capture all of those potential deductions and access them quickly and easily when tax season rolls around—you can save yourself a lot of time and money year-round.

Cover image by Freepik.

source https://zapier.com/blog/accounting-bookkeeping-software-freelance/

No comments:

Post a Comment