Almost half of small business owners despise bookkeeping. It's time-consuming, doesn't bring in money, and requires headache-inducing calculations. But it's necessary.

Online accounting software helps—but choosing the right software can be difficult. How do you know which features and benefits you need? Which price structure best fits your business? FreshBooks, QuickBooks Online, and Xero are three of the biggest names in the online accounting business. They each offer unique benefits, so to help you choose, we'll take a look at the features of each and how they stack up against one another.

What We Looked For

FreshBooks, QuickBooks, and Xero all have the basic features you'd expect from business accounting software, but they still have very different takes on the process. For this comparison, we looked at five factors—plus a number of bonus features—that are relevant for small business owners. Click on any feature below to jump to the section that's most important for your business.

- Pricing

- Ease of setup

- Invoicing and payments

- Expenses and bills

- Reporting and dashboards

- Bonus features

Or you can jump to our comparison table to see all the features at a glance.

Pricing

FreshBooks: Three tiers, based on client numbers

FreshBooks has three pricing tiers, each with an increasing number of billable clients. The Plus and Premium plans have similar sets of features, but if you bill over 50 clients each month, you'll need to step up to the Premium plan.

| Plan | Price | Clients | Features |

|---|---|---|---|

| Lite | $15/month | 5 | Unlimited invoices and estimates, time tracking, online payments, expense importing |

| Plus | $25/month | 50 | Same as Lite features, plus payment reminders, late fees, recurring invoices, and proposals |

| Premium | $50/month | 500 | Same as Plus features |

You can save 10 percent on any plan by paying annually instead of monthly, and team members can be added for $10—they'll be able to track time, add expenses, and collaborate on projects. If you have more 500 clients or bill for more than $150,000 per year, you might save money with FreshBooks Select.

See FreshBooks' full pricing page for more details on features and plans.

QuickBooks: Lots of options, based on user numbers

| Plan | Price | Users | Features |

|---|---|---|---|

| Self-employed | $10/month | 1 | Track income and expenses, estimate quarterly taxes, invoice and accept payments, track miles |

| Simple Start | $20/month | 1 | Track income and expenses, maximize tax deductions, invoice and accept payments, send estimates, track sales tax |

| Essentials | $35/month | 3 | Same as Simple Start features, plus bill pay and time tracking |

| Plus | $60/month | 5 | Same as Essentials features, plus project tracking, inventory tracking, and 1099 management |

You can add payroll for $39/month (+$2/employee/month) and full-service payroll for $99/month (+$2/employee/month). All subscriptions and payroll plans come with a 50 percent discount for the first three months.

See QuickBooks' pricing page for more details on features and plans.

Xero: Easily scalable, based on number of people on payroll

| Plan | Price | Payroll | Features |

|---|---|---|---|

| Starter | $9/month | None | 5 invoices and quotes, 5 bills, 20 bank transactions |

| Standard | $30/month | 5 people | Unlimited invoices, quotes, bills, and bank transactions |

| Premium 10 | $70/month | 10 people | Same as Standard features, plus multi-currency support |

| Premium 20 | $90/month | 20 people | Same as Premium 10 features |

| Premium 100 | $180/month | 100 people | Same as Premium 10 features |

The Starter plan, while very affordable, is only meant for very basic needs or a long-term trial. Once you step up from there, you get access to every feature (except support for multiple currencies, for which you'll need the Premium 10 plan or higher).

See Xero's pricing page for more details on features and plans.

Ease of Setup

As we walk through the various features of these apps, you'll start to see a trend: FreshBooks is a relatively straightforward solution, while QuickBooks and Xero offer more nuanced functionality. And, as you might imagine, the learning curve is proportionate.

FreshBooks: Clear, friendly walkthroughs

Getting everything set up in FreshBooks is easy, thanks to the straightforward walkthroughs. They tell you what you need to get started, ask you for the relevant information, and offer tips throughout the process. You can be ready to start using FreshBooks in just a few minutes after making some easy choices.

When it comes to importing existing data, you can import clients, expenses, items, services, and taxes into FreshBooks via spreadsheet templates. If you're already using another accounting service, you'll need to export this data first and make sure that the necessary columns are in place.

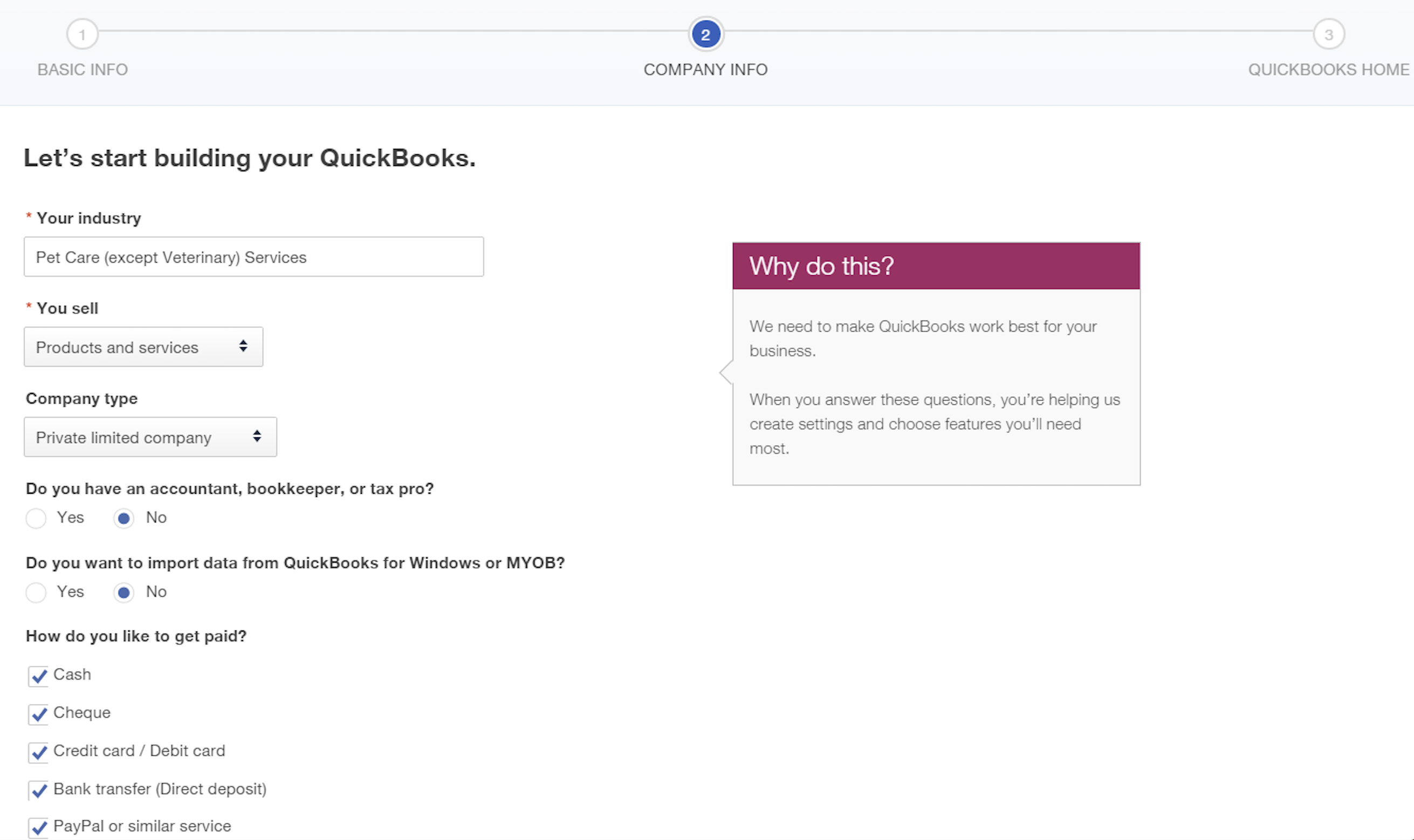

QuickBooks: Middle ground between simplicity and complexity

While the setup wizard in QuickBooks isn't quite as friendly as FreshBooks, it does provide the necessary help for getting your business information into the right places. When you're done answering questions and adding your information, the software will be customized to suit your business.

QuickBooks offers a few options for importing Excel sheets, but if you want to import a large amount of information (like previous invoices), you'll want to expand your integration options with Zapier.

Xero: Seamlessly import your data

Because the software as a whole is more complicated than the other two options, there's more to set up in Xero. The setup wizard is a big help, though, and makes the process much easier.

With its Excel templates, you can import just about anything into Xero, from customers to invoices. Download the templates, get your data from your previous client or spreadsheet into the right format, and reupload it. It doesn't get much easier.

Because Xero and QuickBooks are two of the biggest names in online accounting, Xero is doing what it can to convert QuickBooks Online customers into Xero customers: It provides instructions for easily converting from QuickBooks to Xero. It involves some account maintenance, exporting, and importing, but the process is relatively simple—and it brings over all of your information.

Invoicing and Payments

Online accounting software should make it easy to create and send invoices, while also providing features that scale to the needs of different businesses. And although you can accept payments with other solutions, being able to accept credit cards or take other online payments directly from your invoices is a nice service to offer to your customers—and it's convenient for you too.

FreshBooks: Ultimate simplicity

FreshBooks provides a streamlined invoicing system. There aren't as many options as QuicksBooks or Xero, but that makes it easier to get up and running quickly.

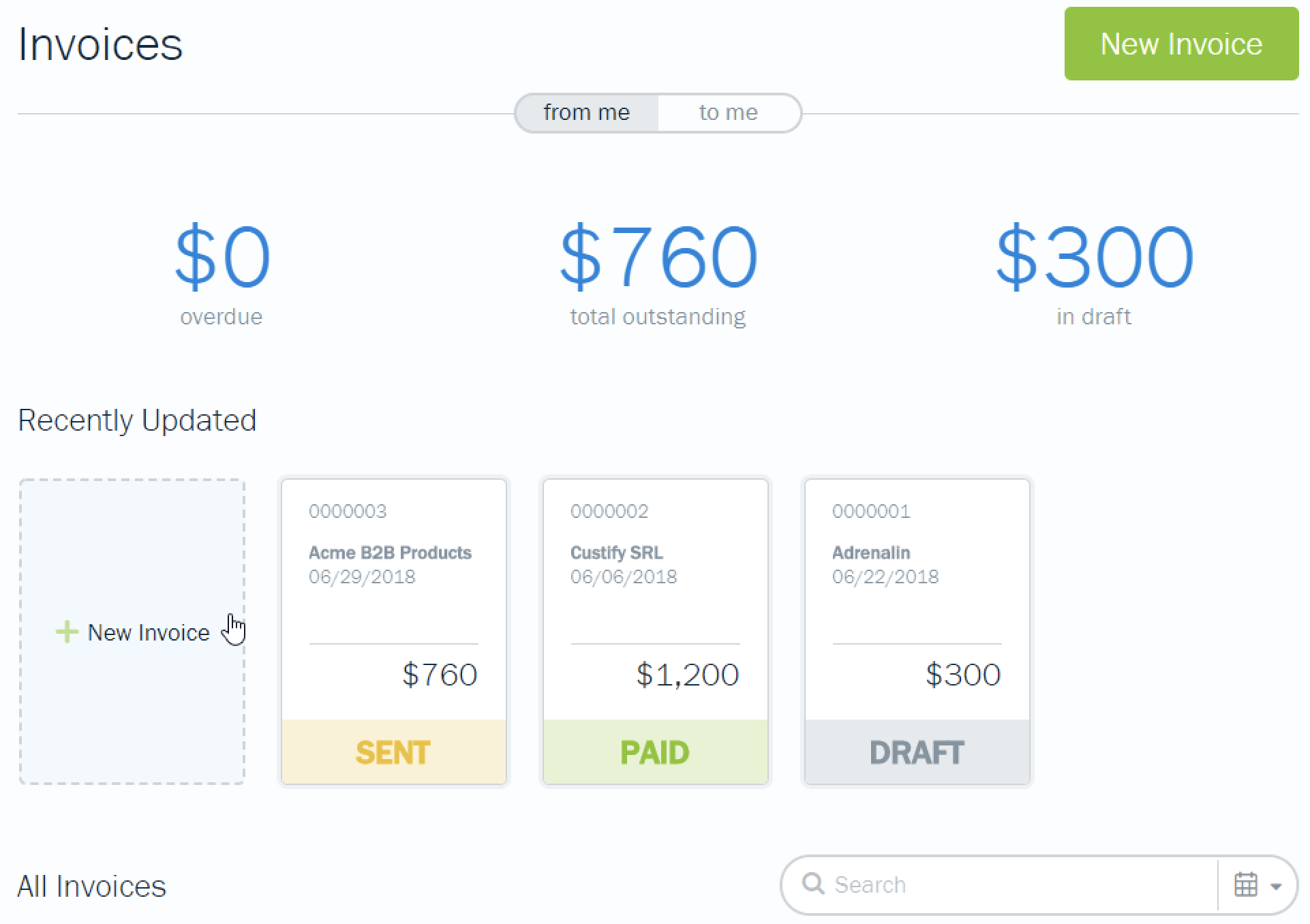

The invoices screen provides you with a concise overview of the status of your invoices.

And customizing your invoices is just as simple: You'll find two templates, two fonts, and a choice of color. It's enough to let you inject a bit of your brand without overwhelming you with complexity. FreshBooks will send reminder emails on a schedule of your choosing, and you can customize the text of those emails too.

QuickBooks: Accept credit card payments in person

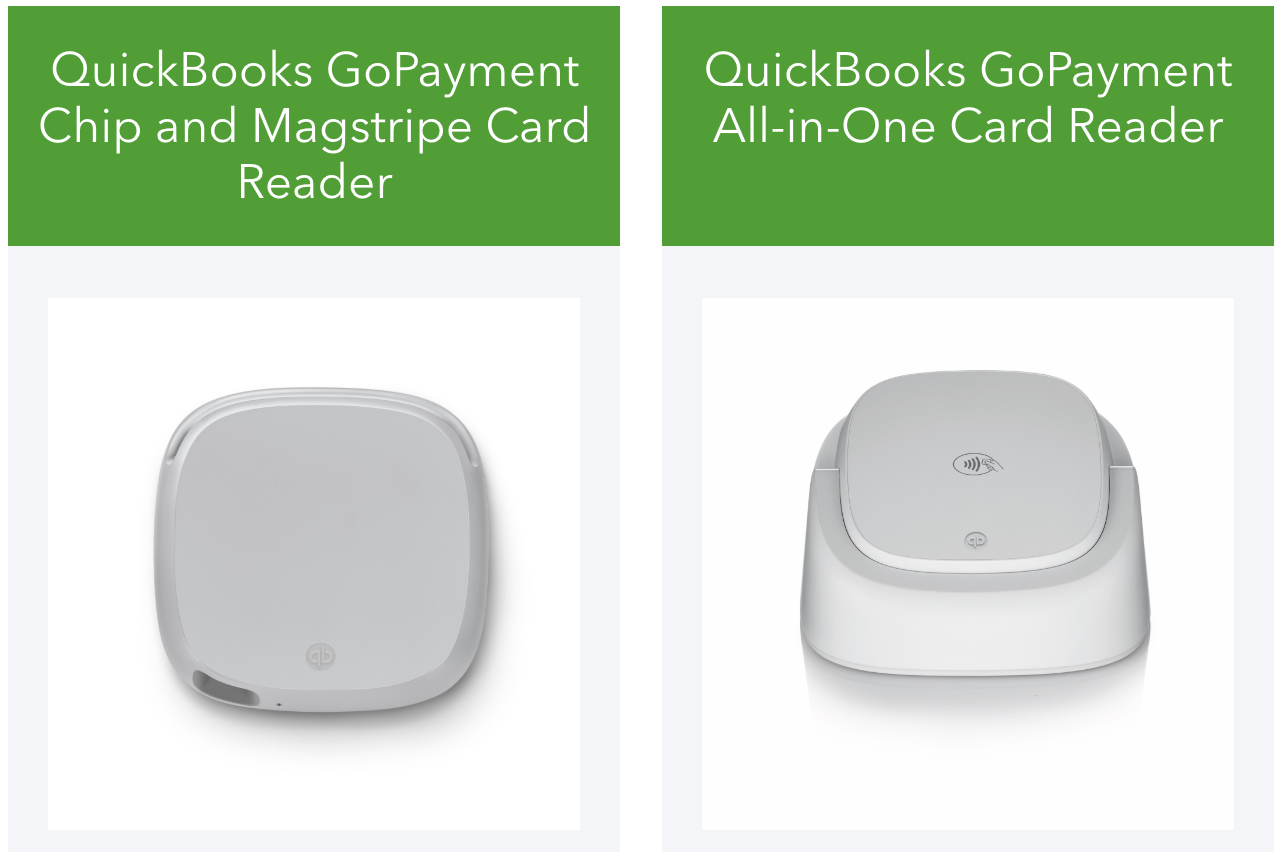

If you sell products at a brick-and-mortar location, QuickBooks' mobile card readers will save you the headache of working with a separate payment service.

When you sign up for QuickBooks' GoPayment service, you get a card reader that accepts chip and stripe payments for free. If you want to take Apple, Android, and Samsung Pay, the all-in-one reader will cost you $49.

Both readers charge a transaction fee of 2.4 percent + $0.25 for cards that are swiped, inserted, or tapped. If you manually key in a card, you'll pay 3.4 percent + $0.25.

QuickBooks' invoicing provides the functionality you'd expect from online accounting fost. You get more customizability than with FreshBooks' invoices, as well as integrations with QuickBooks' inventory options and a basic dashboard that shows you where your money is. And customers can pay directly from your invoices by credit card (2.9 percent + $0.05), Apple Pay, or free ACH.

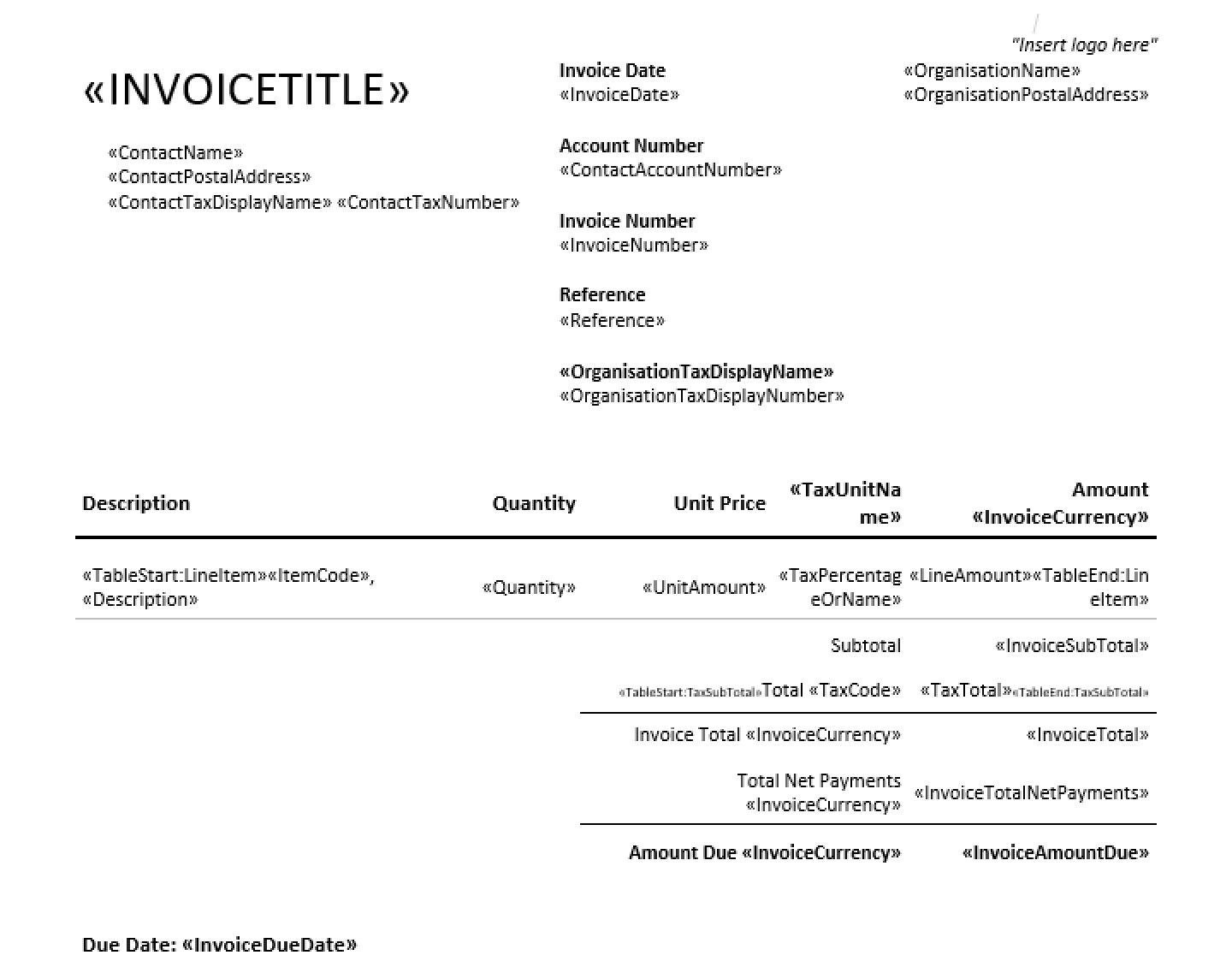

Xero: Extreme customizability

Xero provides the ultimate level of customizability for your invoices. You can use the web-based interface to design invoices, or you can download a .docx template for full customization and save up to 15 different templates in your account.

You also get more options when creating an invoice: In addition to integration with Xero's extensive inventory management system, you can choose different departments for each item to more accurately track cash flow through your company.

Another one of Xero's standout features is its approval workflow. If you want, each invoice can require approval before it's sent. This is useful for companies that have multiple employees generating invoices that need to go through a billing department or an executive. (If you don't need an approval workflow, don't worry—you can just click Approve from the invoice screen instead of Save.)

Expenses and Bills

Unfortunately, running a business isn't all about income: You need to keep track of your expenses too. If you opt for a full-featured app, you may even be able to pay those expenses directly from within the software, simplifying your financial workflow.

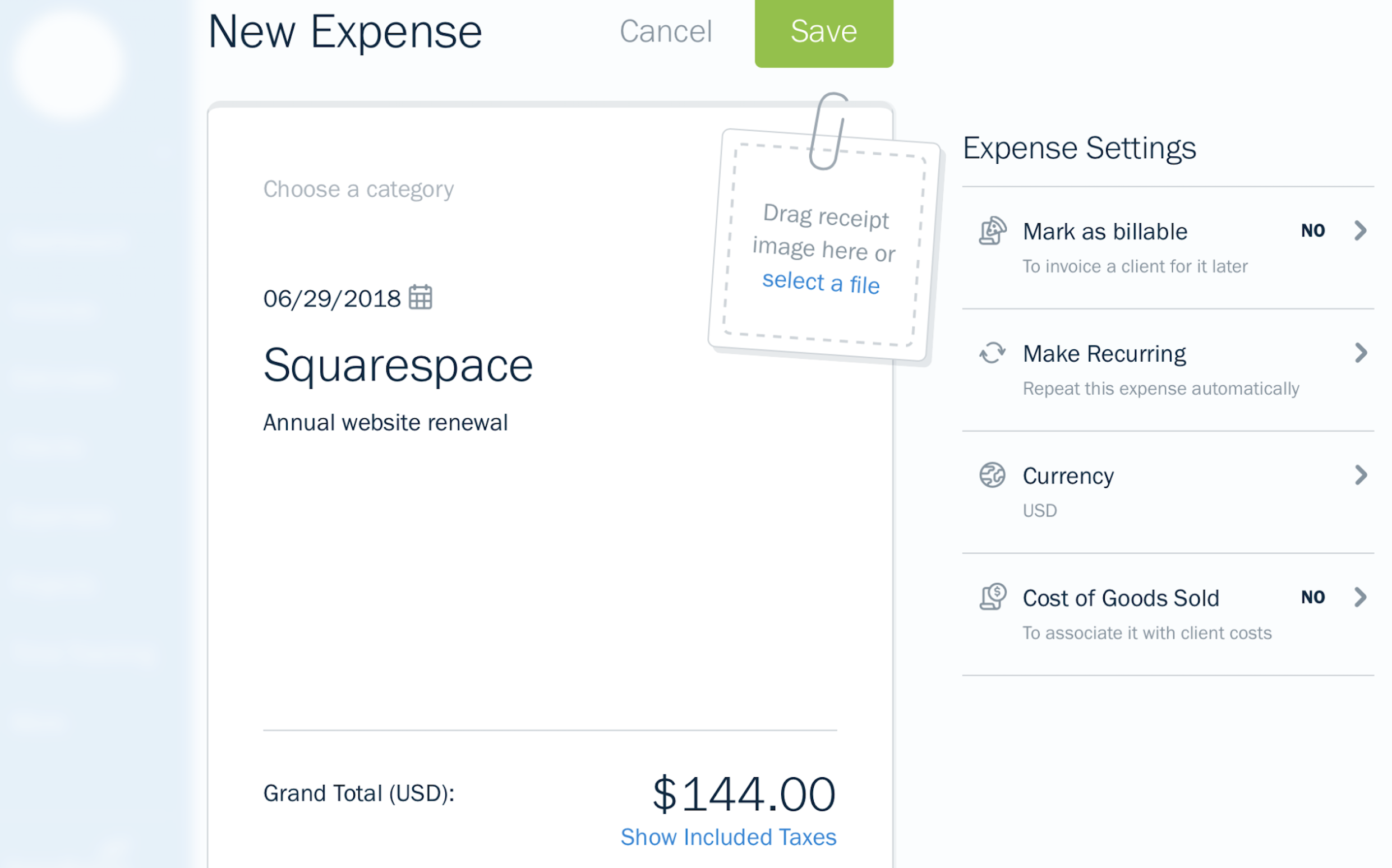

FreshBooks: Quick and easy expense tracking

Like invoicing, expense tracking in FreshBooks is simple and easy. Click New Expense, type in the vendor, the expenses, and the cost, and you're done.

Once you've detailed your expense, mark it as billable or cost of goods sold and save it. You can also assign a category to keep track of where your money's going.

That's it. No approval, no associating with accounts, nothing. Just type it in, and it's logged.

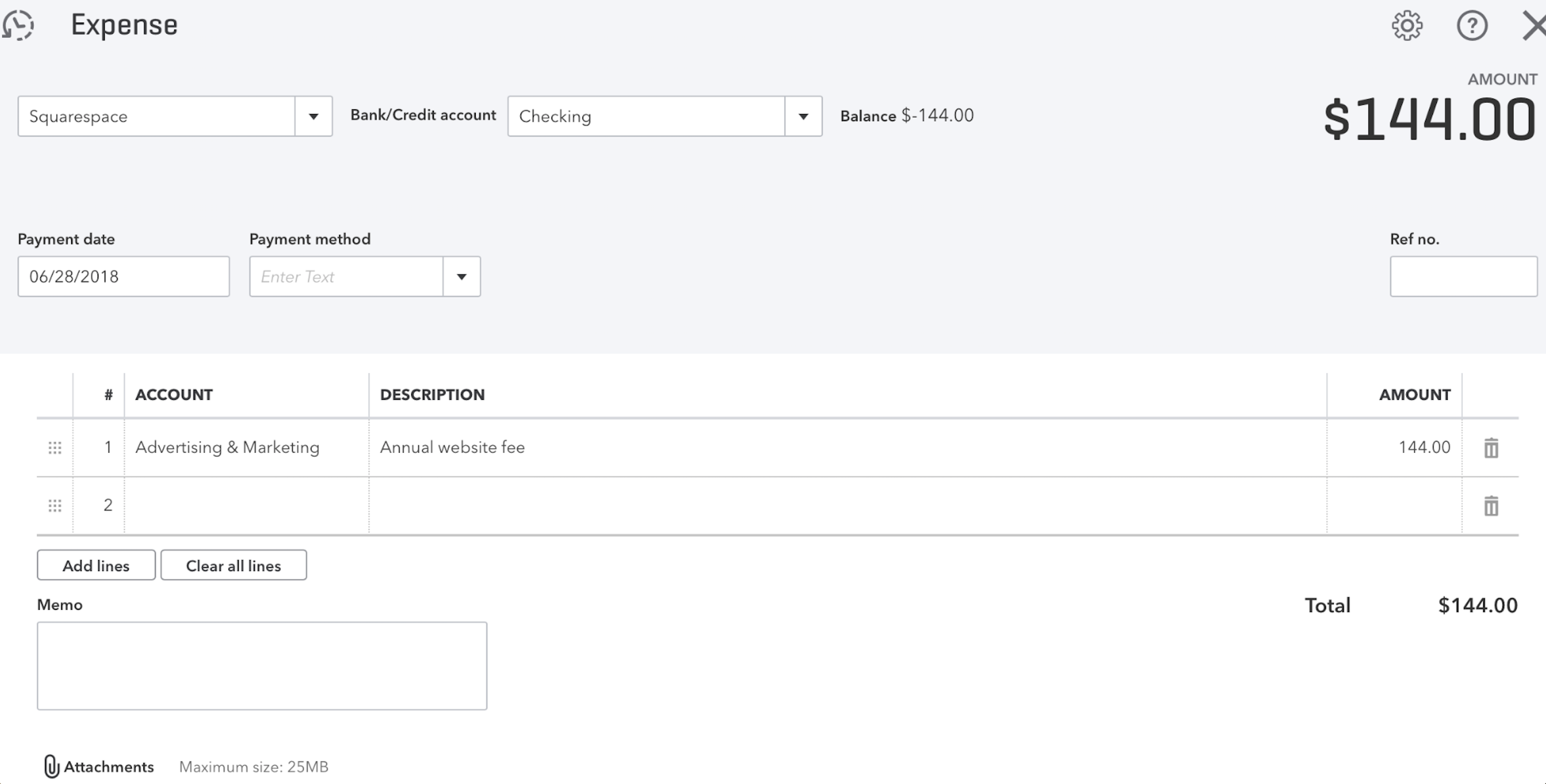

QuickBooks: Standard features, expensive bill pay

Adding an expense in QuickBooks is much like adding an invoice: Choose a payee, add the expenses, and save it. Expenses, however, also require that you choose a bank account from which you'll pay (though "Undeposited Funds" can serve as a catch-all). There are also many company accounts that you can use to categorize your expenses.

You can pay your bills directly from QuickBooks by printing a check (at a cost of $1.99 each) or using a bank transfer ($0.99). A $9.99 monthly subscription brings the costs down to $1.49 and $0.49, respectively.

Xero: Free batch payments from your bank accounts

Like QuickBooks, Xero can print checks and process bank transfers for your expenses. But Xero allows you to upload a batch payment file to your bank for free (if your bank supports this functionality, of course). There's also a built-in integration with Bill.com to process bill payments, along with many other bill pay integrations.

Just like with invoices, there's the option for an approval workflow for expenses, allowing supervisors or managers to keep an eye on how employees are spending money. And the files inbox lets you email bills and invoices directly to Xero to keep them all in one place (both FreshBooks and QuickBooks require a more traditional upload).

Reporting and Dashboards

With effective reporting and informative dashboards, your accounting software can give you a solid overview of the financial health of your company. The larger your company, the more likely you are to need complex reports, which are especially useful for accountants, stakeholders, and funders.

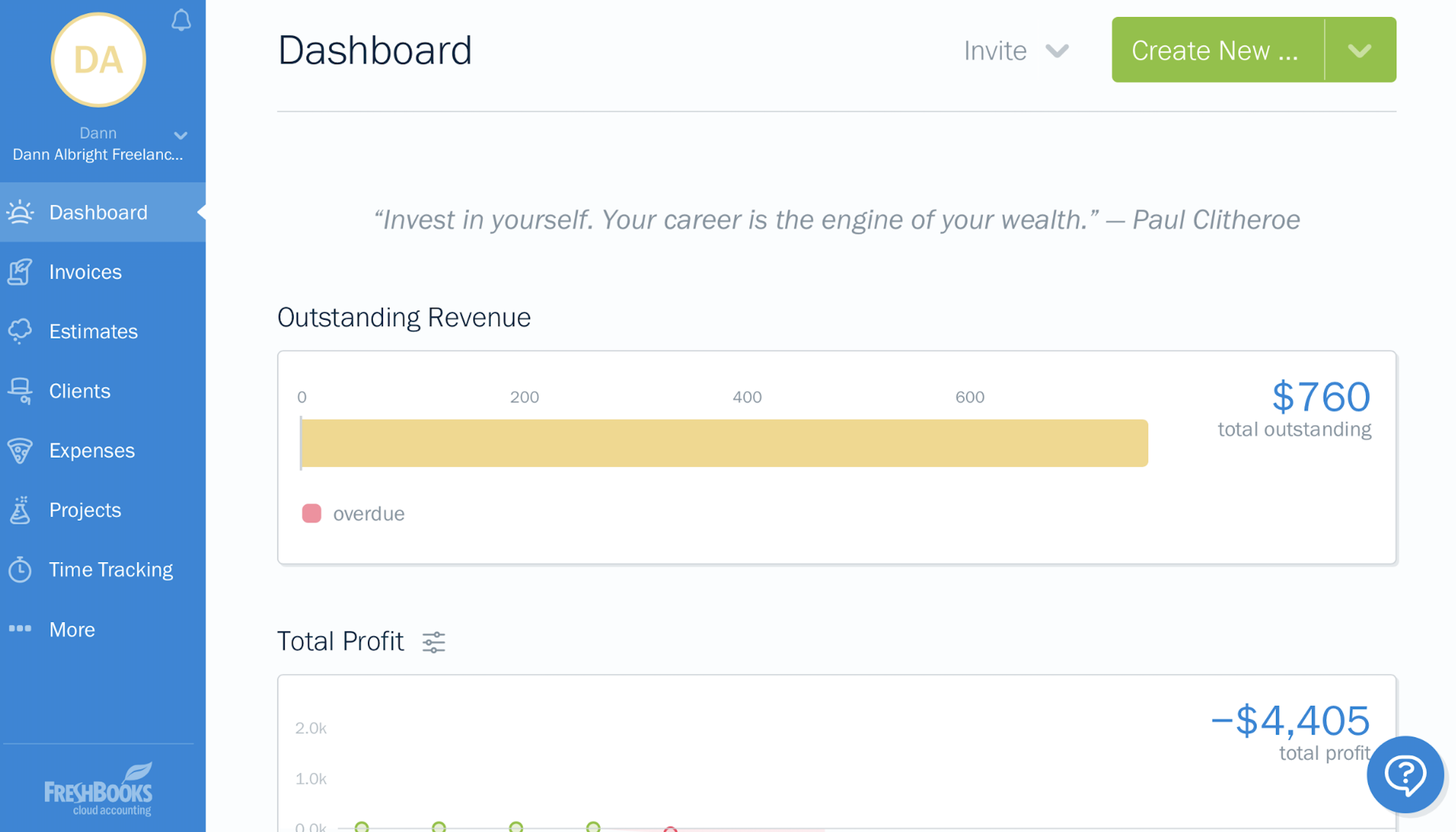

FreshBooks: Accessible but basic reporting

Like the rest of is features, the FreshBooks dashboard is simple. It has five graphs: outstanding revenue, total profit, revenue streams, spending, and unbilled time. While this doesn't tell you everything you need to know about your business, it provides you with the basics in an easy-to-scan view.

You can run seven downloadable reports from your dashboard: profit/loss, tax summary, accounting aging, invoice details, expense report, time entry details, and payments collected. It's not nearly as much as the competitors offer, but it will be more than enough for freelancers and very small businesses.

QuickBooks: Standard reporting features

QuickBooks' dashboard contains information on invoices, expenses, bank accounts, profit/loss, and sales—but it isn't customizable. Aside from changing the timescale on some of the categories, you're stuck with the current charts and layout.

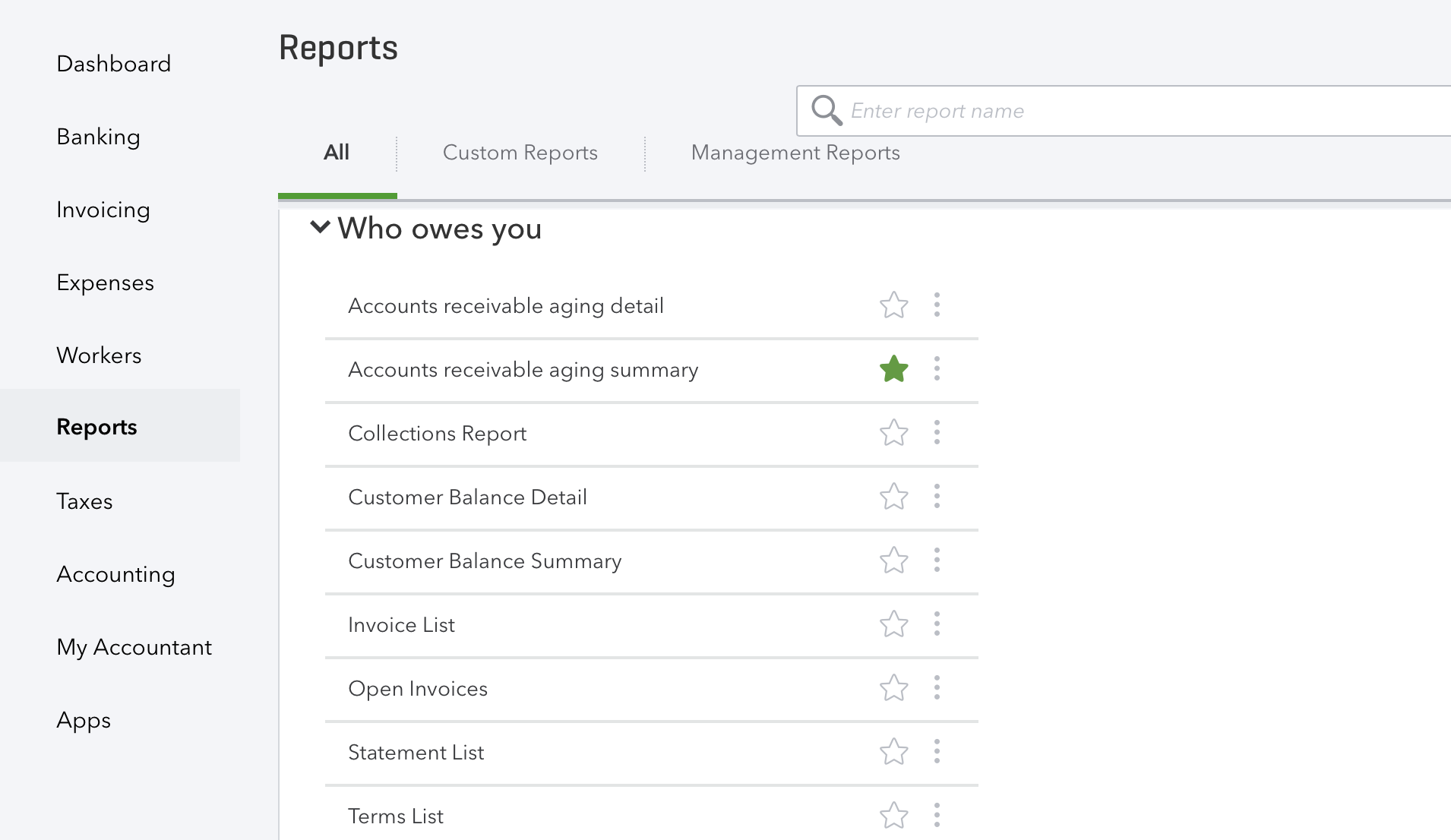

As for reports, you'll find just about anything you could want for a small business. There are dozens of different reports in the categories of Sales, Customers, Accounts Due, Payroll, Expenses, and a variety of others. Reports are instantly created in-window, and you can email, print, and share them with just a couple clicks.

Each report can be customized after you run it, and you can save those customizations as the default. You can also create custom reports, save your most-often-run reports in a favorites section, and access high-level management reports.

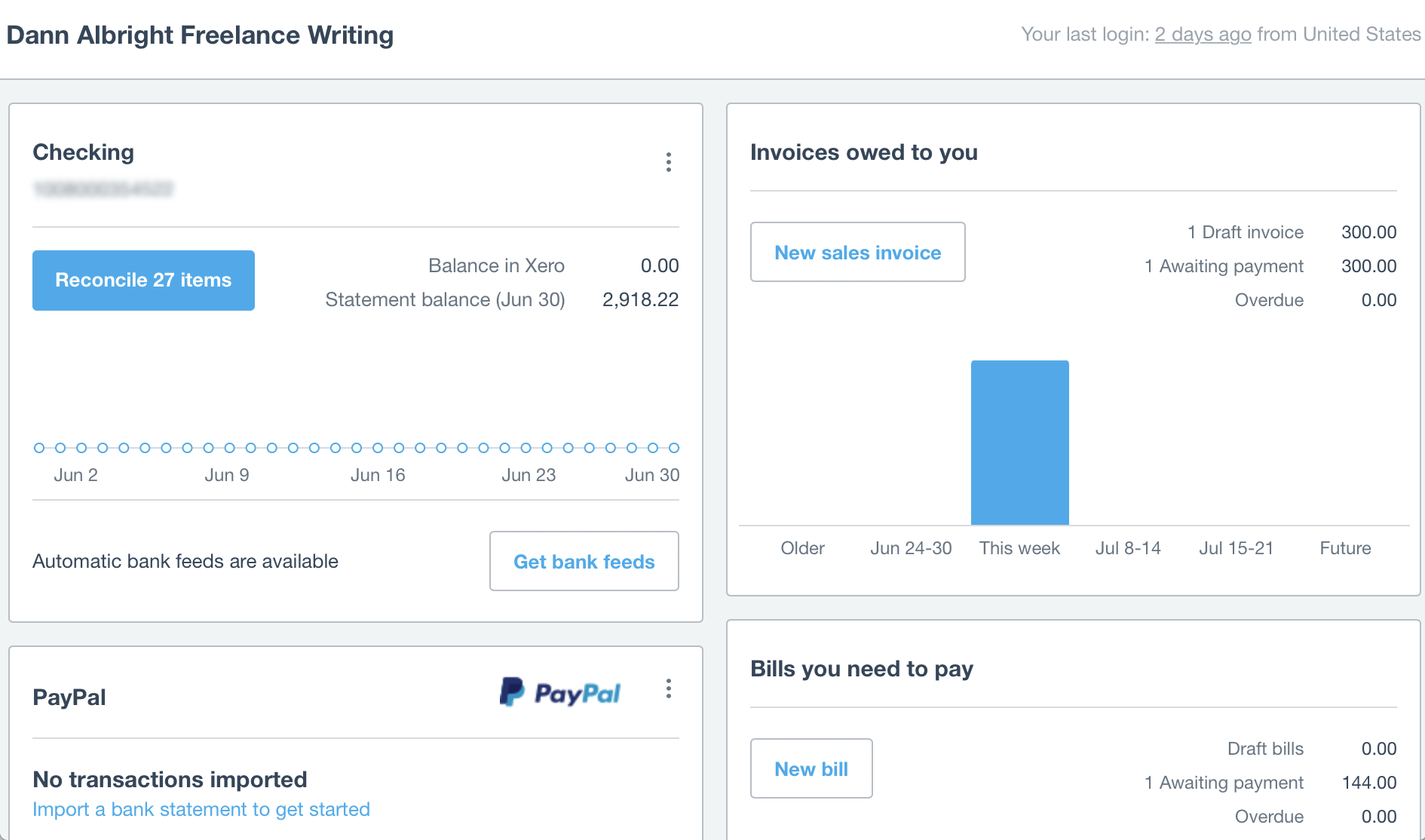

Xero: Standard reporting with in-depth dashboards

The standard Xero dashboard is similar to QuickBooks'. It includes account balances, invoices owed, bills to pay, cashflow, and expense claims: enough to give you an idea of your business performance without including too many details. Unlike in QuickBooks, Xero allows you to reorder the items and hide or show any you'd like.

What sets Xero apart is the Business Performance dashboard: an especially useful report that highlights debt ratio, gross profit percentage, current liabilities to net worth ratio, and more—all graphed for easy reading.

Bonus Features

Project management

While project management isn't a core part of accounting, it's a big help when you're charging by the hour, keeping track of time spent, or calculating your capacity. And even if you don't need project management capabilities in your accounting software, there's a good chance you could be using other project management software. If the two can integrate, that's one less step you'll need to take.

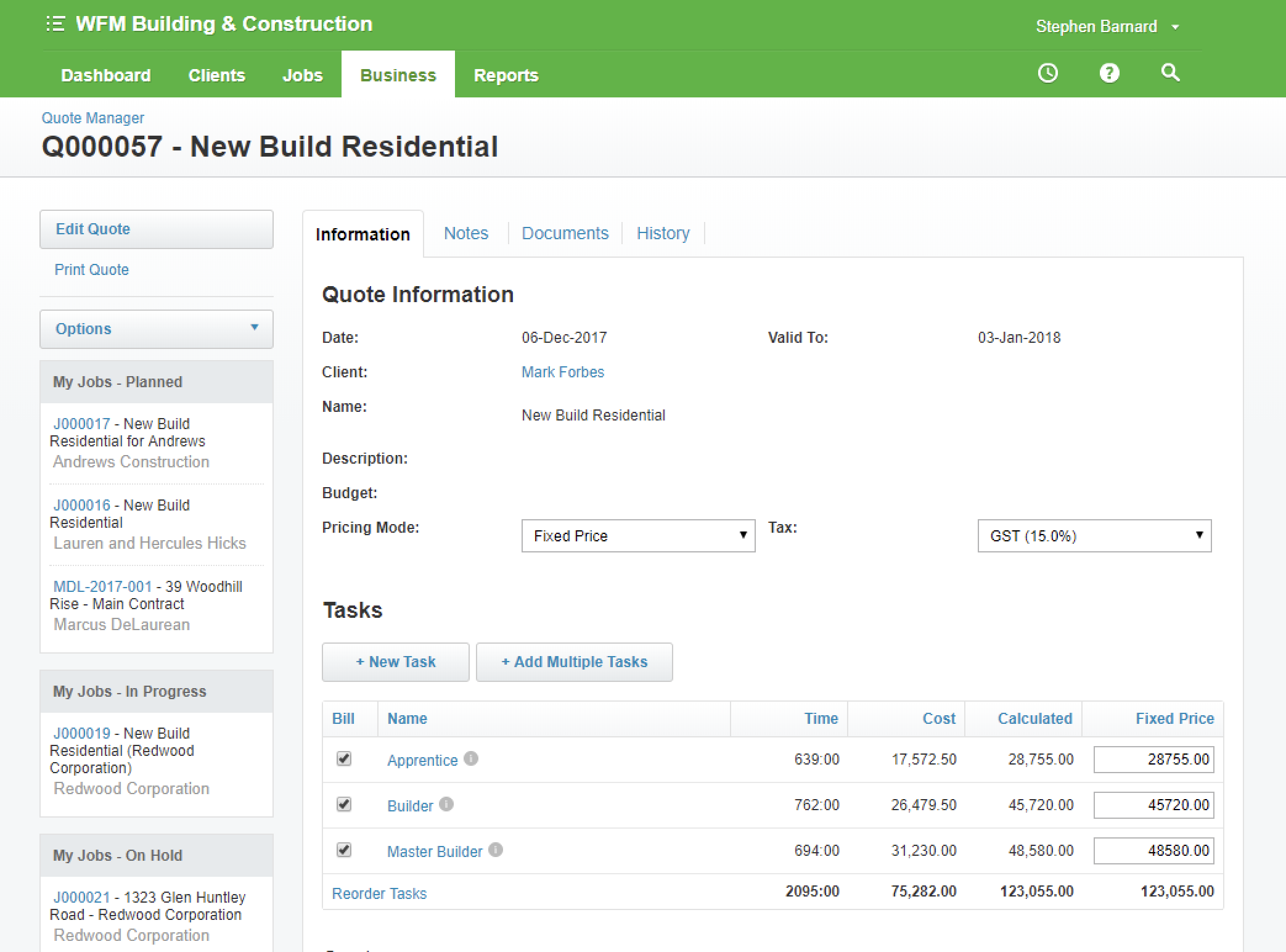

When it comes down to it, Xero is the clear choice for integrating project management with your accounting software. In FreshBooks, you can add projects, set your hourly rate for that project, track your time, and communicate with your team if they're also using FreshBooks. And if you're subscribed to QuickBooks Online at the Essentials or Plus levels, you can use the built-in time-tracking features. But Xero actually has two different sets of project management tools built in to the platform:

-

Xero Projects is the smaller-scale option. It's currently free, though Xero has implied that it will likely cost about $25 per month. It tracks time and costs on every job: You can assign invoices, costs, fees, and other relevant items to each project.

-

WorkflowMax, Xero's fully featured project management system, is built for larger businesses. In fact, you can subscribe to WorkflowMax without using Xero at all (though the integration between the two is one of the things that makes it so useful). WorkflowMax can keep track of clients, leads, purchase orders, documents, capacity, and a wide range of other business factors. Customizable fields, project statuses, reports, and purchase orders place a strong focus on profitability.

Inventory tracking

Not every small business has inventory—but if you do, having a solid tracking system integrated into your accounting software is a big help. And if you're willing to shell out a bit of extra cash, you can get respectably advanced inventory tracking capabilities.

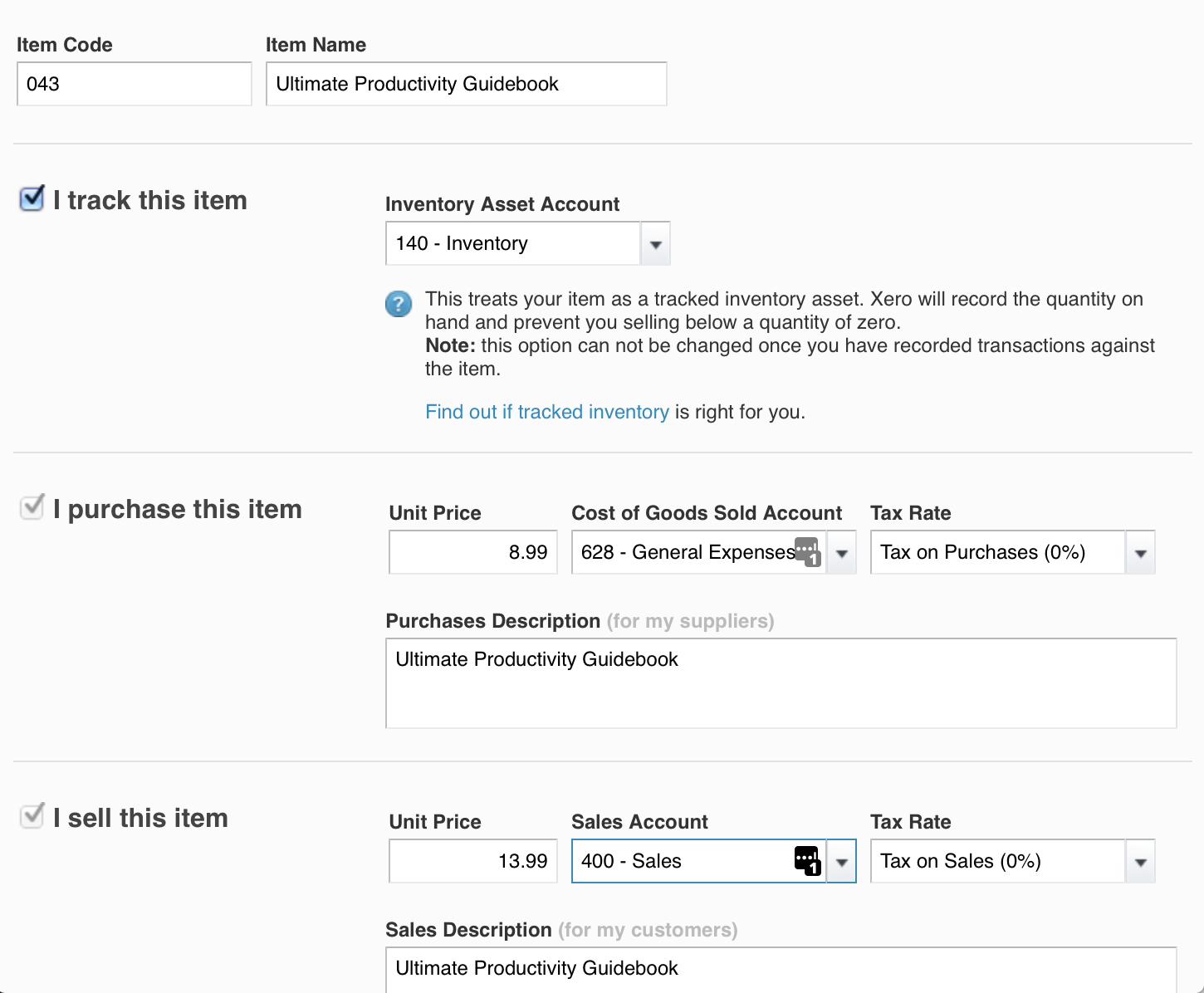

Once again, Xero takes the cake here. There's no inventory management built into FreshBooks, though integrations will help with that. With a QuickBooks Online Plus subscription, you can create custom categories and subcategories, track quantities on hand, import inventory information from an existing spreadsheet, create purchase orders, and generate inventory reports. But Xero's built-in inventory management is robust enough to cover all the bases.

Tracked inventory items make it easy to populate your invoices with all the right information and keep track of how much stock you have on hand. Untracked inventory is great for services or products that you always have on hand and don't need to worry about reordering. You can specify tax rates and accounts for each item, and mark items inactive when you're not selling them. You can also get detailed analysis on profitability, stock levels, and reordering.

The best part: All of your inventory information is available when you're creating an invoice. Just select the right item and prices are populated.

If you're already using another inventory management app, there's a good chance you can integrate it with Xero, and you can upload a spreadsheet with your current inventory to make the transition easier.

Filing Taxes

Business taxes can be a beast—you'll want any help you can get from your accounting software. FreshBooks allows you to give access to your accountant, which is helpful, but choosing software that integrates directly with an online filing service is the most streamlined choice.

As you might expect, QuickBooks integrates directly with TurboTax, another Intuit product. There's an easy walkthrough to set up your sales tax, and once you've done that, QuickBooks will automatically calculate your sales tax rates and the taxes you need to pay on various timescales. There are plenty of tax reports, including tax liability and taxable customer reports, and you can print a check to pay your sales tax directly from QuickBooks.

Xero integrates with Avalara for updated tax rates and automatic filing, and all of your taxes are sorted into jurisdictions and synced with your invoices. You can also use custom tax rates with multiple components. And, of course, you can get a sales tax summary and audit report with just a few clicks.

Payroll

Do you have employees to pay? If you do, you'll need to keep track of your payroll expenses, taxes, and administrative things like leave requests. You could pay for a standalone payroll solution, but choosing online accounting software that takes care of payroll for you is a huge convenience. Of course, you'll have to pay for it.

FreshBooks has no built-in capabilities for payroll, but QuickBooks and Xero both give you options. With QuickBooks, you need to pay extra:

- Enhanced Payroll ($39/month + $2/employee/month) lets you pay employees and contractors via direct deposit or paper checks, and you can print paystubs or checks directly from the app. QuickBooks will help you file your federal and state payroll taxes and manage your W2s at the end of the year.

- Full-Service Payroll ($99/month + $2/employee/month) has all of the same features, but includes support for setting up, filing, and paying your payroll taxes. You can get expert help on new employee forms, pay types and deductions, and other tricky issues. It also includes same-day direct deposit and a no-penalty guarantee.

Unlike with QuickBooks, payroll is included in different Xero pricing plans (up to a certain number of employees). While payroll isn't available in every state with Xero (and electronic payroll is available in even fewer), it does provide many options if you live in certain places. Xero makes it easy to manage employee leave, multiple pay calendars, multiple pay rates, and automatic tax calculations.

Should I Use FreshBooks, QuickBooks, or Xero?

FreshBooks, QuickBooks Online, and Xero meet different needs—it's all about who you are and what you're looking for.

-

FreshBooks is great for very small businesses and freelancers. It's easy to use and feature-light, so you won't be paying for features you don't need.

-

QuickBooks will appeal to businesses with brick-and mortar locations. Two types of card readers and an Intuit payment service make it easy to take payments on the go. (And direct integration with TurboTax is a plus.)

-

Xero is the ultimate all-in-one accounting software for growing businesses. It has everything: project management, payroll, inventory, and an approval workflow. A simple pricing model means it grows with your company—and without hassle.

Finally, here's an at-a-glance feature comparison. Scroll to the right to see the whole table.

| Pricing | Ease of Setup | Invoicing | Expenses/Bills | Reporting/Dashboards | Project Management | Inventory Tracking | Taxes | Payroll | |

|---|---|---|---|---|---|---|---|---|---|

| FreshBooks | $15-50/month | Friendly setup wizards | Minimal customization | Easy expense tracking | Basic | None | None | Manual | None |

| QuickBooks | $10-60/month | Few import options, some available for purchase | Basic customization | Expensive bill pay | Extensive | Time tracking | Features in higher-level subscriptions | Integration with TurboTax | Full-service available |

| Xero | $9-180/month | Many import options | Completely customizable, approval workflow | Bill pay via bank upload, approval workflow | Extensive, with great Business Performance dashboard | Fully featured PM options | Advanced tracking built in | Integration with Avalara | Included in subscription |

Automate Your Online Accounting

Once you've chosen your accounting software, be sure to make the most of it by automating some of the most tedious processes. Using an automated workflow called a Zap, you can delegate the data entry side of things to the robots and spend more time growing your business.

- Automatically create invoices whenever a deal reaches a certain stage in your CRM:

- Automatically notify your team whenever you receive a payment:

- Automatically add new CRM contacts to your accounting software:

- Automatically create invoices for completed orders:

Don't see the workflow you're looking for? Create your own with our Zap editor.

source https://zapier.com/blog/freshbooks-vs-quickbooks-vs-xero/

I read your blog and I'm very impressed. It's very useful. I'm QuickBooks Technical Support advisor and We provide QuickBooks support service for small businesses. You can dial our toll-free number to hire one of Intuit certified ProAdvisor to fix the problem or technically assist you. Call now & get the best out of QuickBooks.

ReplyDeletehttp://www.quickbooksdesktop.com

You just nailed on the difference between FreshBooks vs. QuickBooks vs. Xero.

ReplyDeleteFor Xero Inventory Management Add on, go here

https://emergeapp.net/integrations/xero-inventory-management/

The desktop version of QuickBooks is mostly the preferred choice of many business owners. With the support services at QuickBooks Desktop Support Phone Number +1 844-233-5335 you can easily overcome the issues in this application. Read more- https://tinyurl.com/y5t5uz4e & visit us- https://www.qbooksupportphonenumber.com/quickbooks-desktop-support-phone-number/

ReplyDeleteNice Blog It’s a really informative for all. We are providing technical support in Quickbooks for MAC support phone number it is Specifically designed for MAC operating system.We are providing 24*7 technical support so if you need any query.Please call us our Toll-free Number + 1-800-986-4607

ReplyDeleteNice Blog It’s a really informative for all. QuickBooks is a reliable accounting software. You can easily use and install QuickBooks.We are providing technical support in Quickbooks Support Phone Number 1800. Please call us our Toll-free Number + 1-800-986-4607.

ReplyDeleteAvail instant & effective solutions by dialling Quickbooks Support Phone Number 800-901-6679. You may find other number as well available on the web. But here, you can avail quality support from our support team. Highly skilled & Certified Proadvisors are there for you, to assist with round the clock services. Get 24*7 of support, at whatever you come across the technical defects.

ReplyDeleteNice Blog ! Are you looking for some expert help to fix your quickbooks issue? Get instant solutions by contacting us at our Quickbooks Desktop Support Phone Number . Do not waste your precious time by wandering here and there. Reach us now 1-800-986-4607.

ReplyDeleteQuickBooks Pro Support Phone Number

ReplyDeleteQuickBooks Pos Support Phone Number

QuickBooks Update Support Phone Number

QuickBooks Payroll Support Phone Number

QuickBooks Desktop Payroll Support Phone Number

QuickBooks For Mac Support Phone Number

It's interesting that many of the bloggers to helped clarify a few things for me as well as giving.Most of ideas can be nice content.The people to give them a good shake to get your point and across the command.

ReplyDeleteExpense Reports Apps