Online business all starts with a simple transaction.

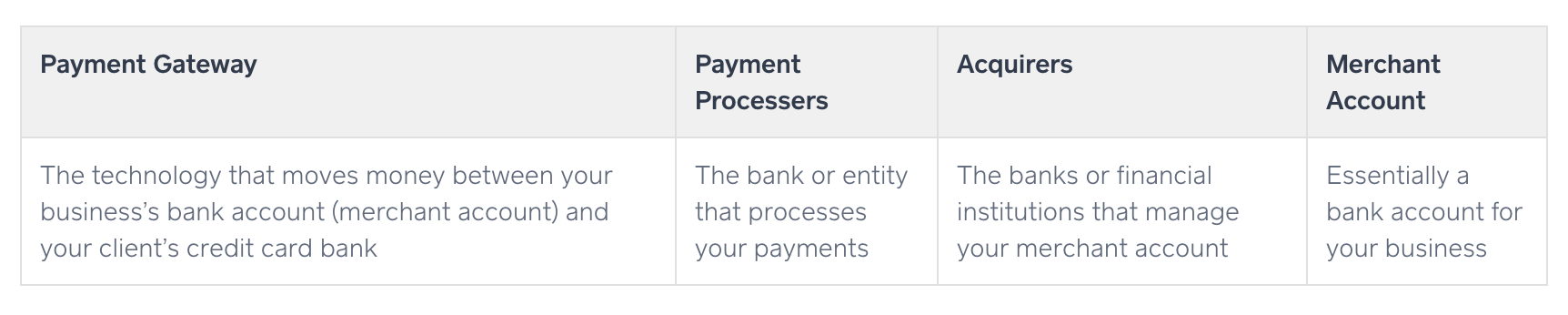

Back in the day, in order to complete that transaction, you needed a merchant account—a special bank account that allows you to accept credit card payments—and loads of cumbersome equipment. Today, all you need is a standard checking account and an online service that accepts payments and transfers them to your bank account. Those online services are called payment processors or payment gateways.

Here, we're going to examine two of the most popular payment processor options out there: Stripe and PayPal. Both have distinct advantages and disadvantages, so let's see how they stack up.

Common Features and What We Looked For

PayPal and Stripe each carry unique benefits and challenges. How hard is it to set up for your website? Can you take payments in person? What about using your mobile phone to accept payments? What if you have to type in a credit card number by hand? Is it secure? These are all questions you should be asking before kicking off the decision-making process.

Here are the 10 factors we considered in our showdown. Click on the section that matters most to your business, or jump to the end to see our complete comparison table.

- Cost

- Transactions

- Website testing

- Security

- Subscriptions and recurring billing

- Virtual terminal

- Invoicing

- Disputes, refunds, and chargebacks

- Mobile payment processing

- Tracking and reporting

Cost

Stripe has a slight edge on international orders

Stripe and PayPal both allow you to start with no monthly fees. That means that if you aren't selling anything, then you aren't paying anything. This is hugely important for micro-businesses that might not be able to foot even a tiny monthly bill for a payment processor.

They also both have similar pricing structures beyond that:

Sales within the U.S. for both processors are 2.9 percent per transaction plus $0.30. So, if you made a sale for $10.00, you'd pay $3.20 to Stripe or PayPal. This likely isn't a coincidence and demonstrates just how competitive the two companies are with each other.

For international sales, the transaction fee goes up to 4.4 percent for PayPal but only 3.9 percent for Stripe, which gives Stripe an advantage if you're doing a lot of international business. And one other note: If you use the PayPal Here card reader from your phone, you'll get away with a 2.7 percent transaction cost, which is a slight advantage over online sales.

Bottom line: The pricing is pretty similar, so this isn't a make-or-break category.

For complete pricing, see PayPal's and Stripe's pricing pages.

Transactions

PayPal is easier unless you use a third-party shopping cart

If you're selling a product or service online, you need at least two pieces to make it work:

- The payment processor

- A shopping cart application

To get that shopping cart application, you have a couple options. First, you could integrate with a third-party service; e.g., the website builder you used to make your website. Stripe and PayPal both integrate with all the big eCommerce website builders like Shopify, WooCommerce, BigCommerce, Wix, and Squarespace. Sometimes it's as simple as logging in to both accounts, and other times you need to get an API key from Stripe or PayPal. But either way, If you go that route, it's equally as easy to connect either payment processor with whatever shopping cart you use.

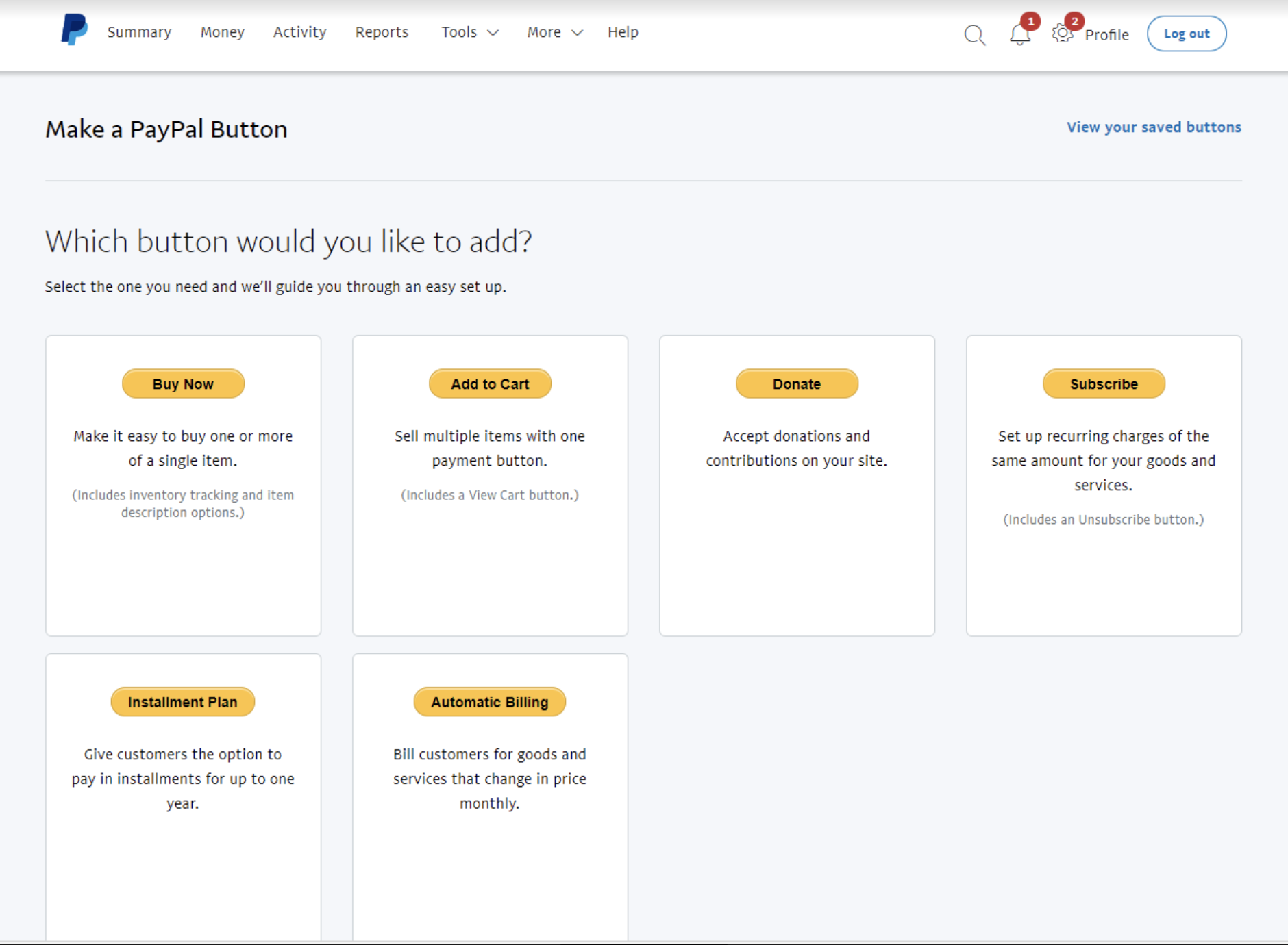

But if you've built your own website from scratch and you want to embed the shopping cart using only PayPal or Stripe, that's where PayPal starts to pull into the lead. PayPal offers a shopping cart solution that you use on any website where you can paste HTML code. Just click on the Business Setup link from your dashboard and choose "On your website." Then follow the prompts to get a block of code that will render as a button that directs users to a shopping cart. Stripe, on the other hand, requires some JavaScript and HTML experience to get the job done. There's a decent amount of sample code available in the documentation, but without some basic coding knowledge, you might feel lost.

So if you're not working with a third-party solution and you're a coding newbie, PayPal is probably your best bet.

Testing Your Website

Stripe and PayPal both offer robust testing options

Adding a checkout solution to your site, flipping the switch, and getting paid sounds tempting—but don't get ahead of yourself. Especially when there's money involved, you don't want want any "oops" moments. So first, you need to test.

But how do you test a payment system without using real money? The solution is what's called a sandbox, i.e., a testing site that mirrors your actual site. Much like the childhood image evokes, the sandbox is a place to play around. In this case, you're playing around with your site, testing different features to be sure that everything works before making it live to your customers.

PayPal allows testing through sandbox accounts that can be accessed through their developer site. Once you've created your sandbox account, you can log in to a sandbox version of PayPal and experiment. Create checkout buttons and use test credit card numbers provided by PayPal (or the sample buyer PayPal account that comes with the sandbox) to check that everything works from initial click through to purchase.

For the same purpose, Stripe offers a test API key alongside the live API key, and any transactions made using the test key are considered dummy transactions. They also provide sample credit card numbers, along with a suggested series of tests to be sure that any errors are handled properly before taking your site live. As you test, full logs are kept so you can review any errors; and while some errors require development knowledge to understand at a glance, there are thorough explanations available in the documentation. Plus, the dashboard can be switched to view test or live data with a toggle button on the left pane at any time. This is in contrast to PayPal, where it's necessary to log in to a completely separate sandbox site in order to test.

Stripe and PayPal both provide a robust set of tools to check that your site's payment system is working well before you let real customers at it. They go about it a bit differently, but they offer sufficient ways to test your site without using any real data.

Security

PayPal handles Payment Card Industry (PCI) compliance internally

When conducting business of any kind online, trust plays a huge role. How do you show that you are a trustworthy seller, and how do you know that your buyers are protected?

Both Stripe and PayPal offer standard user protections like two-factor authentication. The major difference between the two is how they address Payment Card Industry (PCI) compliance. Launched in 2006, the Payment Card Industry Data Security Standards (PCI DSS) are basically a checklist for you to follow that ensures that you perform regular security checks, handle transmission of payment data securely, and don't store credit card data. They're not legally binding, but following these practices keeps your buyers safe—and that's good for business.

PayPal, in general, handles PCI compliance internally as long as you use their own checkout button solution. You give up a little bit of freedom in how it looks, but you're spared the headache of ensuring that buyer credit card information is being handled appropriately.

Stripe is also a PCI DSS compliant organization, but as they point out, it's is a shared responsibility between you and them. They provide a thorough guide—including a self-assessment—to help you confirm that your organization and software are PCI compliant. So if you manage the transactions directly, Stripe requires you to place some additional emphasis on your own security based on the PCI guidelines.

If you're looking for the easiest route to security and compliance without a third-party checkout solution, PayPal takes care of the heavy lifting for you.

Subscriptions and Recurring Billing

PayPal has everything you need

Many online stores are selling a service (like Zapier), not a product (like Amazon). When that's the case, you're much more likely to need recurring billing, i.e., you need to be able to charge your customers on a regular basis. That also means you need to be able to handle different subscription periods, renewals, and cancellations.

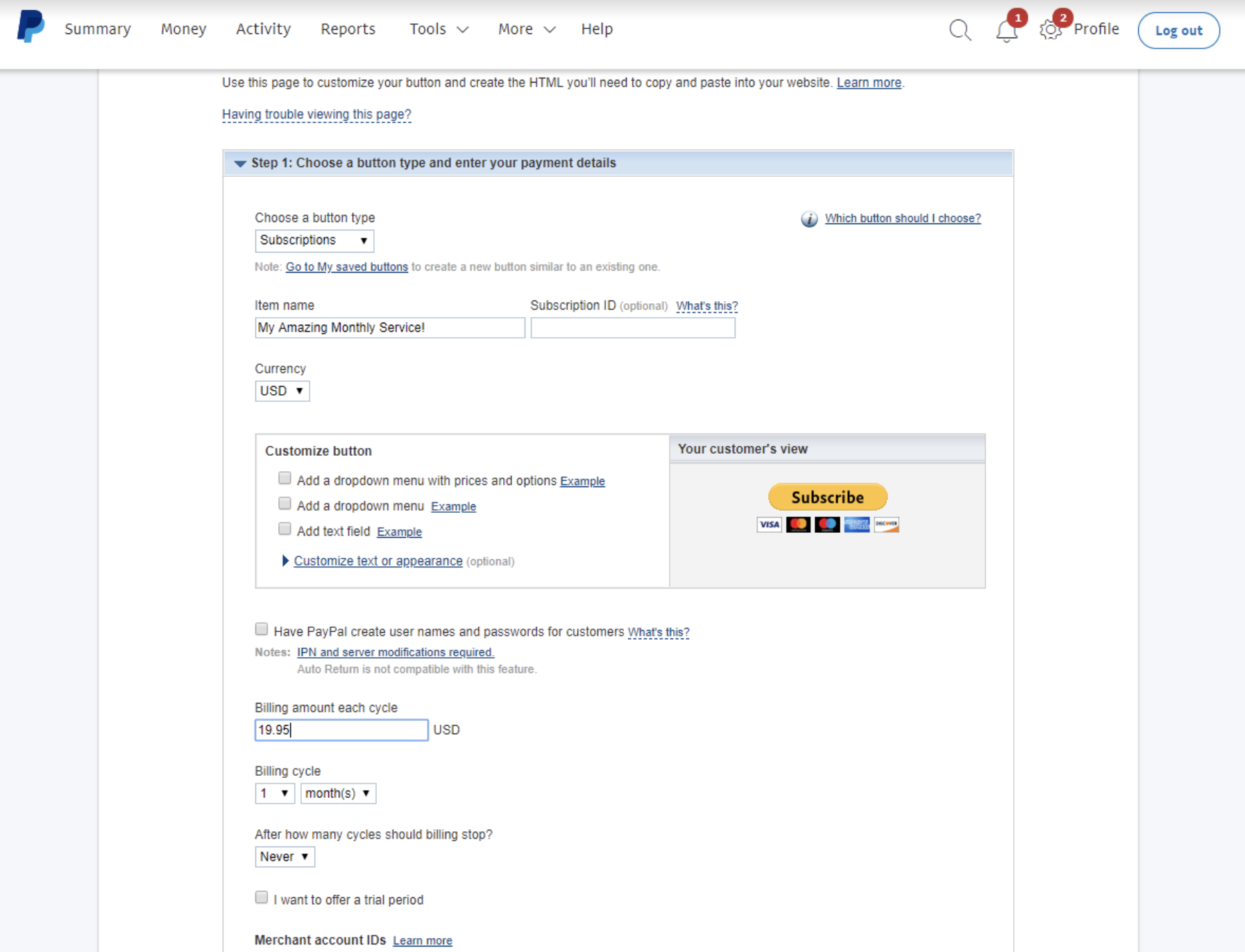

If you use PayPal's button wizard—the same one you used to set up the shopping cart—setting up and managing subscriptions is a breeze. You define a few pieces: what the subscription is for, the billing frequency, and the pricing; and you can add a dropdown menu if you offer multiple subscription options. If you want, you can assign a unique identifier to the subscription to make it easier to track. Users can manage and cancel their own subscriptions from within their PayPal account, but you can also easily create cancellation buttons for them.

In Stripe, on the other hand, you need to manually subscribe users to your services through the dashboard. When subscribing users, you'll define the customer record by entering their personal information, a product, pricing, and terms up front. Because you're handling all this personal information, you risk not being PCI compliant. And if you want users to be able to subscribe and manage the subscription without your intervention, you'll need to invest in some third-party applications that support subscription management—or build your own.

Virtual Terminal

PayPal has a complete but pricey solution

You know when you swipe/insert your credit card at the grocery store? The thing you're swiping the card through is called a terminal. So a virtual terminal is the same thing—but without the physical aspect. It's a spot where you can manually enter credit card numbers in order to process a sale. It's not common practice for eCommerce—since usually customers are entering their own credit card information—but if you take orders over the phone or through the mail, you'll need a virtual terminal. And if you do, both Stripe and PayPal have you covered, but in different ways and with different payment structures.

PayPal's virtual terminal is simple and easy to use. You enter order details including the buyer's name, address, and credit card information, and the items or services being purchased. Then you can print any related receipts, shipping labels, or packing slips for the customer. It's actually quite reminiscent of working at a cash register in a brick-and-mortar store. The catch? It requires signing up for PayPal Payments Pro, which has a $30/month fee, whether or not you make any money.

Stripe doesn't offer a virtual terminal application, but there are various third-party services available, each of which carries its own charges and requirements.

Bottom line: You can potentially get a cost advantage by looking for third-party options with Stripe, but PayPal has a solution ready to go.

Invoicing

Stripe has the better interface

If you're selling a product or a subscription, your customers will usually pay upfront. But many consultants, freelancers, and other service-oriented businesses don't charge clients up front. In some cases, the cost of the work isn't even clear until the project is complete. That's where invoices come in: They're essentially bills that you send to your customers to let them know how much they owe you. Most accounting software takes care of this for you, but both Stripe and PayPal also have built-in solutions.

PayPal's invoicing system covers all the bases. It's easy to establish payment terms and line items and specify a purchase order number if appropriate. You can attach a file to an invoice and you can even bill multiple customers at once. An especially nice touch is that you can customize the invoice by adding a company logo. Plus, customer records don't need to be added in advance: You'll need an email address for your customer, at minimum, but you can fill out their name, phone number, address, and other important items with a simple popup.

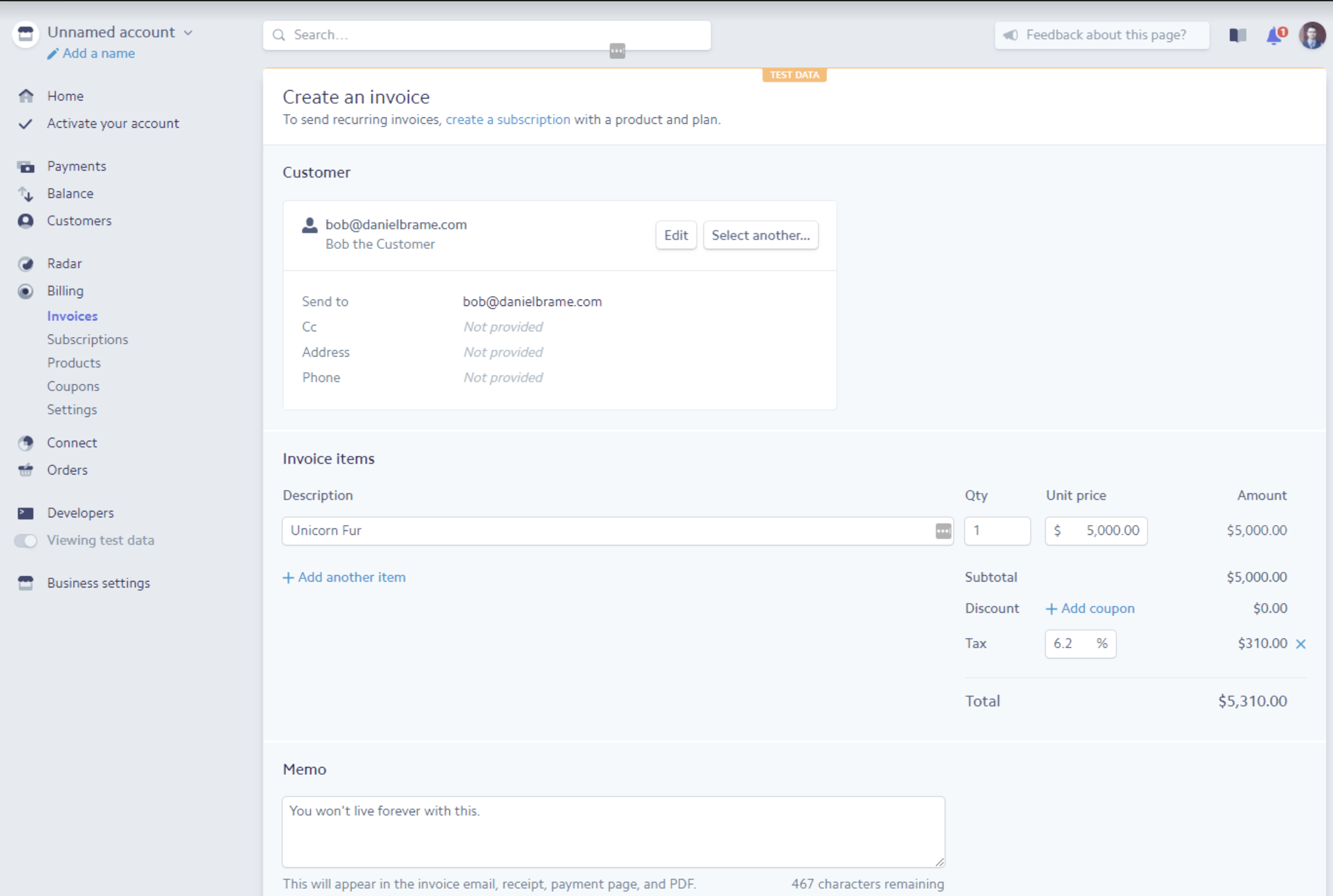

Stripe requires you to create your customer records in advance with all of their contact details, but once they're in the system, it's a simple process to send them an invoice via email. It's one of the few instances where Stripe doesn't rely on third-party services and applications to get the job done, and it's extremely well designed. There are also lots of places to select triggers for emails at various stages of payment; for example, you can receive notifications when there are successful payments or refunds. Unlike PayPal, Stripe doesn't allow for file attachments or the ability to bill multiple customers at once, but you can customize a few basic items such as color and logo.

When it comes down to it, both services offer a simple and effective method of sending invoices, but Stripe's UI is just a bit friendlier.

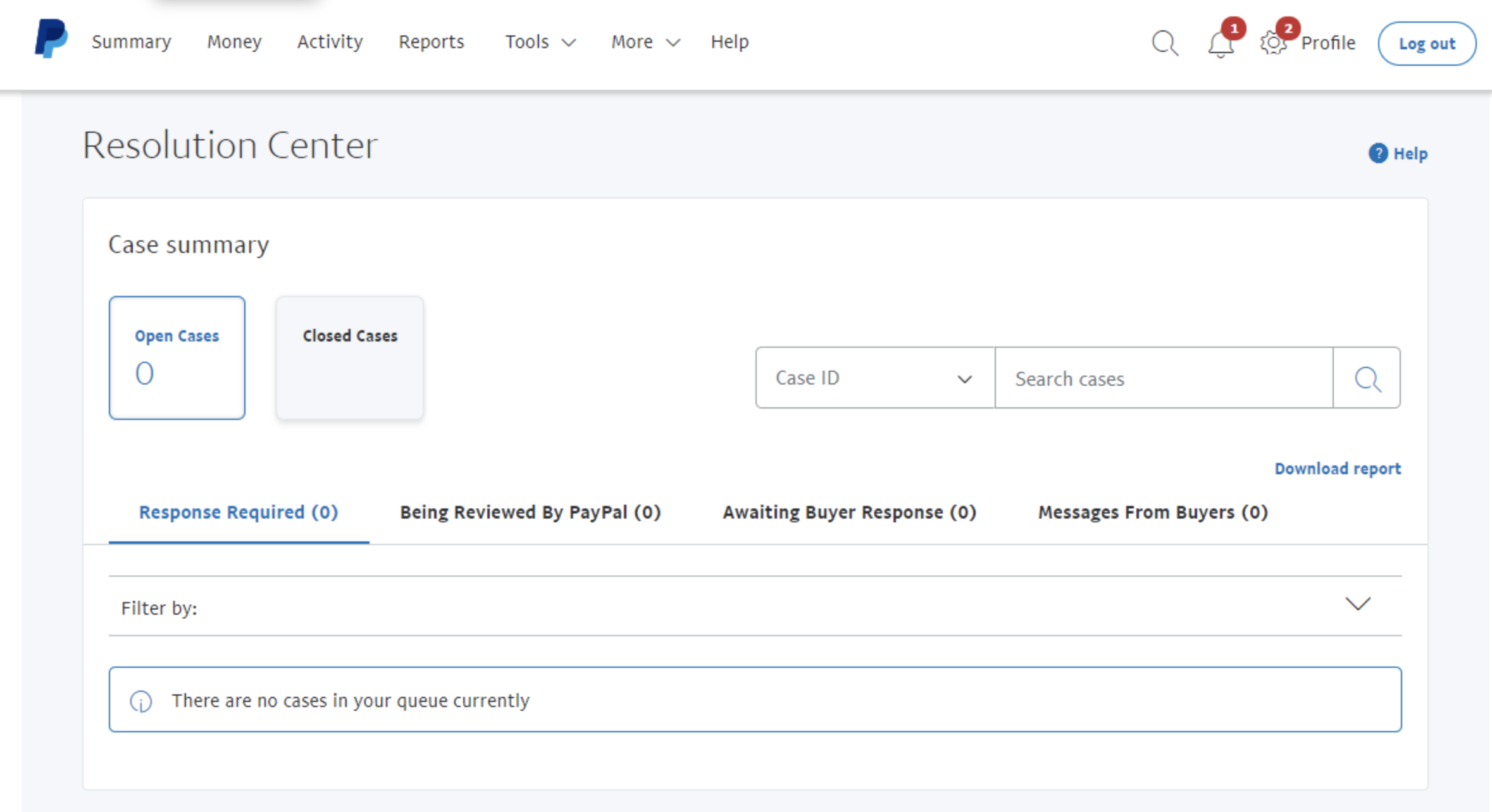

Disputes, Refunds, and Chargebacks

It depends who you want to decide the outcome

PayPal is a fairly comprehensive online payment system—not just a payment processor. People keep money in PayPal, can pay directly from their PayPal balance, and so on. For that reason, PayPal deals with disputes, refunds, and chargebacks internally. And PayPal is notorious for their refund policy. Refunds can be requested by buyers up to 180 days after the sale is made, regardless of the seller's own individual refund policy. Even if you as the seller decline the refund, PayPal anecdotally tends to rule in favor of the buyer if they use the Resolution Center to dispute your refund decision. Having said that, PayPal makes the process easy for you. Whenever there's an action for you to take, you'll receive an email with a link. Just follow the link and the prompts in the resolution center, and PayPal handles the rest.

Stripe, on the other hand, is primarily a payment processor, which means you can't store money there: It's just there in a holding pattern until it ultimately goes to your bank. As such, it doesn't have a refund policy of its own and doesn't decide the outcome of disputes. If someone wants a refund and you don't provide it, the buyer has to go to their credit card company to dispute it directly.

Although Stripe doesn't make any decisions, it does capture and facilitate the arbitration conducted by the credit card company. If a dispute occurs, it can be accessed from the dashboard under Payments and Disputes, and you can submit evidence to the credit card company through that Stripe interface. But be careful when refusing refunds: If the dispute doesn't fall in your favor, you're on the hook for a $15 dispute charge.

In the end, both Stripe and PayPal offer an easy way to manage and resolve disputes. Which one you choose will depend on who you want rendering verdicts: the payment processor or the credit card company.

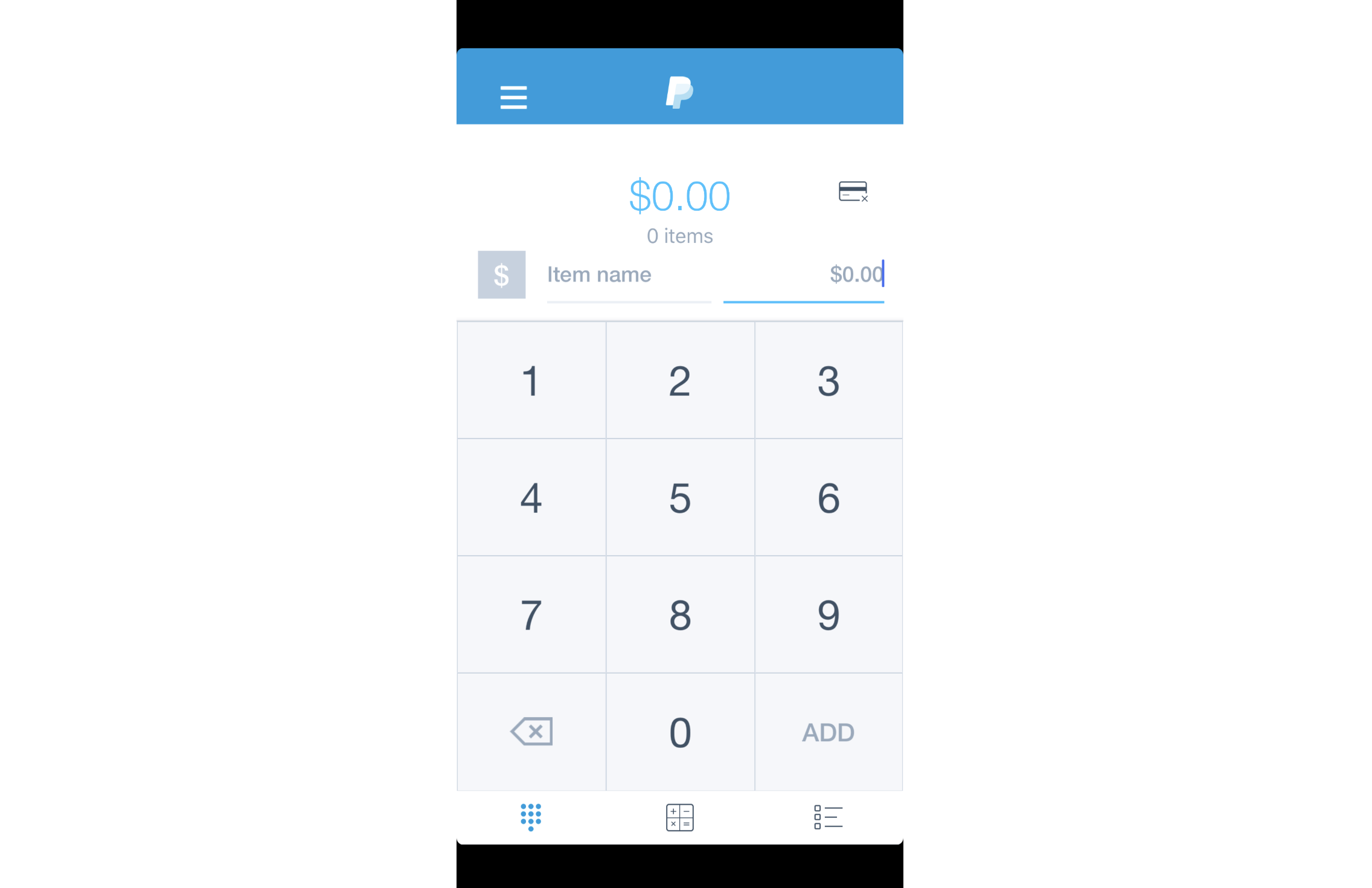

Mobile Payment Processing

PayPal has its own app and card reader

When it comes to payment processors, a combination of app, hardware, and service puts a credit card terminal in your pocket. Mobile payment processing gives you the ability to conduct in-person sales with only a card reader and your mobile phone or tablet. It's like a virtual terminal but without the added expense.

PayPal has a mobile app called PayPal Here that's supported on iOS and Android, and once you sign in, you'll get an easy-to-use card reader shipped to you. Stripe, on the other hand, doesn't have their own app, but they do recommend a number of third-party alternatives. Many of them are competitive with the PayPal app, but you'll likely spend a fair amount of time finding the one that works for you—and paying extra for it.

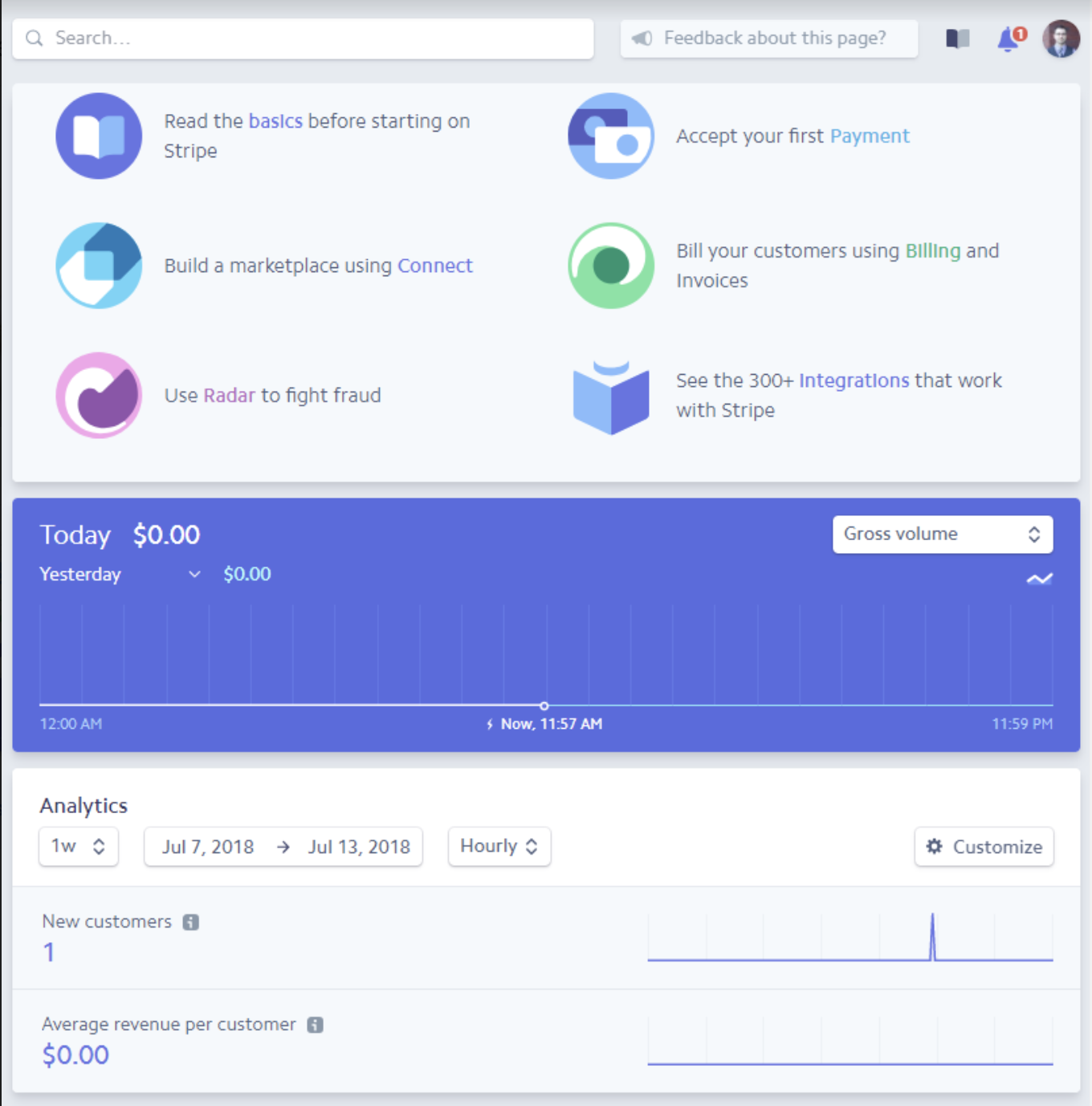

Tracking and Reporting

PayPal has a wider range of accounting reports

For tracking and reporting, we're looking at two questions:

- How easy is it to find and download data?

- How much additional work does it take to get common accounting reports?

Stripe has the definite edge in terms of ease-of-use. Simply navigate to the Payments and Customers section to download a list of transactions in a certain date range. Finding records is similarly straightforward thanks to the freeform search box. And if you need to be a bit more formal, there's a filter button with some common items to search for, such as the created date or whether it was a delinquent charge. There's also a sophisticated customer-specific page: It only takes a few seconds to pull up a customer, check to see if they had any recent orders, or verify their personal information.

PayPal also has a robust method of searching transactions through their Activity view. While the search bar isn't quite as freeform, you can still find what you need between that and a dropdown that tells the system the kind of information you're looking for. You can also look at customer-specific information, but unlike in Stripe, customer details are typically tied to a PayPal account that you can't edit, so it's only for reference.

In terms of formal reporting, PayPal has a plethora of accounting reports that'll make you feel confident that come tax time or quarterly review. Stripe, on the other hand, doesn't offer any formal accounting reports.

Which App Should I Use?

The good news: Choosing between Stripe and PayPal is a win-win. They're both reliable and scalable payment processors. The main difference: In certain areas, Stripe is dependent on other applications, which can be a barrier to sellers who are just getting started. PayPal, on the other hand, is a more complete solution on its own.

Our final recommendation? If you're looking to get into business online without any fuss or extra software, it's hard to go wrong with PayPal. If you're already well established and don't mind using third-party services to tie up loose ends, Stripe is a robust and smart choice.

Finally, here's an at-a-glance feature comparison.

| Stripe | PayPal | |

|---|---|---|

| Cost | 2.9% per transaction plus $0.30 | 2.9% per transaction plus $0.30 |

| Transactions | Requires a third-party shopping cart | Simple checkout buttons that can be used on any website |

| Website testing | Alternate between test and live mode via toggle | Complete sandbox buyer and seller account |

| Security | Relies on third-party compliance, but provides guidance | Handles PCI compliance internally if you use their checkout solution |

| Recurring billing | Subscriptions can be entered manually, but otherwise requires a third-party tool | Subscription controls can be defined as buttons for any website |

| Virtual terminal | Requires a third-party solution | Provides a complete but pricey solution |

| Invoicing | Provides a modern interface with fewer options than PayPal | Provides a complete solution with a dated interface |

| Disputes, refunds, and chargebacks | Buyer's credit card company decides outcomes based on evidence provided through dispute section | PayPal decides outcomes through resolution center |

| Mobile payment processing | Provides the service, but requires third-party hardware and app | Provides a complete app and credit card scanner for a mobile device |

| Tracking and reporting | Easy-to-use customer and sale tracking, but lacks full accounting reports | Easy-to-use customer and tracking features with full accounting reports |

| Customer Service | 24/7 phone and chat support | Business hours, seven days a week |

Automate Stripe and PayPal

Whichever payment processor you choose, save yourself time by automating all your workflows related to that software.

Mitchell Parsons, Operations Manager at Atlanta nonprofit Midtown Assistance Center, automates the transfer of data from PayPal to Salesforce when accepting donations. He says, "It automates the records and creates or updates the contact and opportunity records. It is a great time saver in helping us generate our thank you letters and receipts."

Here are some other ways you can automate your workflows with Stripe and PayPal:

- Keep your team in the loop. Zapier will automatically notify you via email or Slack whenever a new payment is processed:

- Don't miss a beat on your bookkeeping. Send all new charges to your recordkeeping app of choice:

- Add customers who use your payment processor to your CRM or email list:

Don't see the workflow you're looking for? Create your own with our Zap editor.

source https://zapier.com/blog/stripe-vs-paypal/

No comments:

Post a Comment