When you work full-time, there’s an HR team or payroll department that takes care of things like withholding taxes from your paycheck and submitting payments to the IRS. When you’re self-employed, that responsibility is entirely your own.

Neglect to track your business income and expenses—or fail to make the required tax payments—and your freelancing career could be over. A disorganized approach to bookkeeping is almost always followed by the hard lesson of heavy tax penalties or lost income.

But you don’t need an accounting degree to keep track of what you make, what you spend on your business, and what you owe the IRS throughout the year. You just need the right financial software that will make it easy to track your income and expenses while letting you focus on your core work.

The Best Accounting, Bookkeeping, and Tax Apps for Freelancers

As the gig economy has grown, so have the number of options for self-employed accounting and bookkeeping software. But not all apps are equal. We set out to discover the best among them, those that met the following criteria:

- They’re simple to use: A user-friendly interface makes accounting less of a chore—minimal clicks or taps to create an expense report, for example, and navigation that doesn't require multiple, lengthy video tutorials to accomplish the core purposes of the app. Compared to enterprises and small-to-medium sized businesses, freelancers usually have fewer financial things to track and take care of, such as tax documentation for employees.

- Core product features for essential tasks: These focus on the bookkeeping tasks freelancers need to complete: invoicing clients, tracking payments, and tracking deductible expenses.

- Beginner-friendly: Users need little-to-no knowledge of accounting and tax laws.

- Digitization: They provide a way to digitize receipts, save them, and record the expenses from your email, phone, or scanner.

- Free trial: They offer a free trial that doesn’t require upfront credit card information.

After looking at nearly 40 accounting and bookkeeping apps that meet these criteria and taking advantage of their free trials to test them out, we narrowed the list down to the nine best tools.

The following nine web and mobile accounting and bookkeeping apps will make your freelancing life easier:

| Icon: | App | Best for: | Price | Platform |

|---|---|---|---|---|

| QuickBooks Self Employed | Freelancers who file their taxes themselves using TurboTax | $10/mo. | Web, iOS, Android | |

| FreshBooks | Freelancers with complex billing needs or multiple products and services | $15/mo. | Web, iOS, Android | |

| Wave | Free invoice tracking and collecting payments via PayPal | Free | Web, iOS, Android | |

| FreeAgent | Freelancers who need a place to create, store, and track estimates | $24/mo. | Web, iOS, Android | |

| Expensify | Freelancers who just want a way to keep track of expenses | Free | Web, iOS, Android | |

| SlickPie | Freelancers who need to invoice in multiple currencies | Free | Web | |

| Shoeboxed | Simple receipt digitization | $15/mo. | Web, iOS, Android | |

| ZipBooks | Freelancers planning to grow their businesses into a larger company | $15/mo. | Web, iOS, Android | |

| AND CO | Accounting and legal tasks | Free | Web, iOS, Android |

QuickBooks Self Employed

Best for freelancers who file their taxes themselves using TurboTax

If you prefer to file your taxes on your own using TurboTax, QuickBooks Self-Employed saves a lot of time when tax season rolls around. Since both TurboTax and QuickBooks are Intuit products, they’re integrated. Transferring data from QuickBooks into TurboTax when it’s time to file taxes saves hours—or days—of manual calculations and data entry.

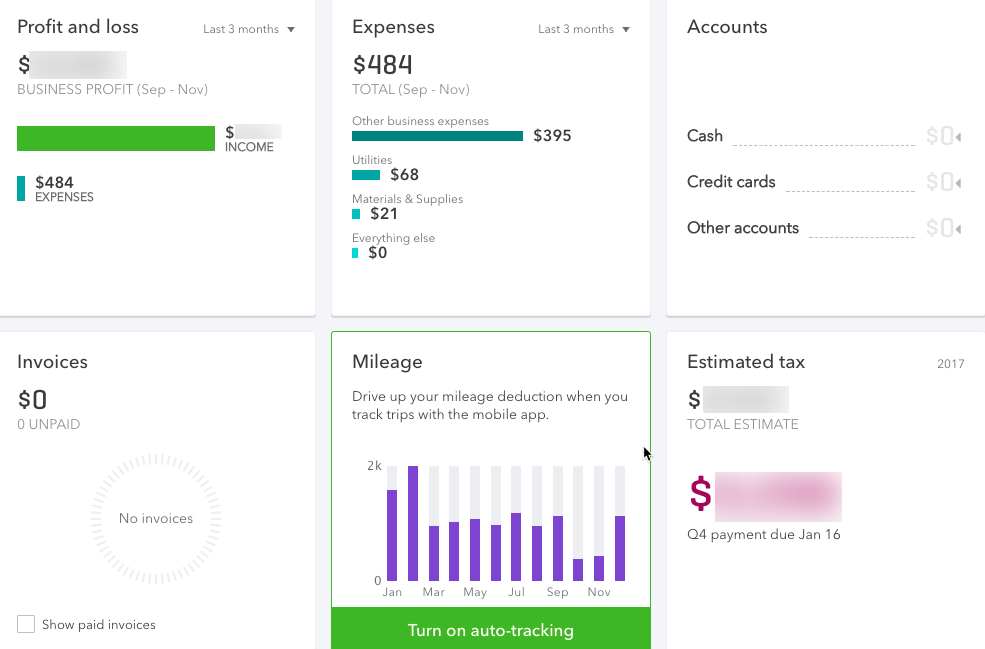

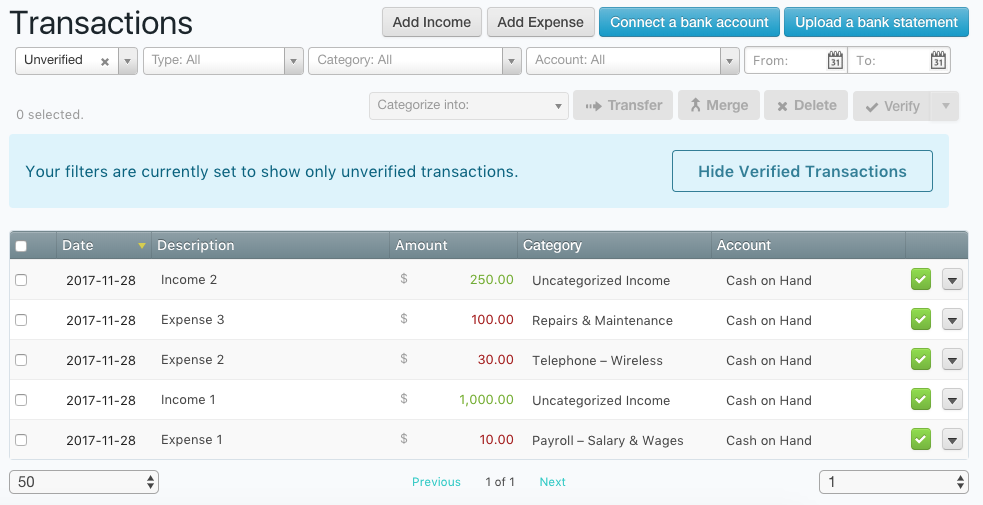

But even if you hire an accountant to prepare your taxes for you, QuickBooks Self-Employed is an excellent bookkeeping tool, particularly for tracking expenses and making quarterly tax payments to the IRS. Connect it with your business or personal bank and credit accounts to automatically capture all transactions. For US-based freelancers, QuickBooks also calculates how much you owe in federal taxes each quarter so you never overpay or underpay.

The QuickBooks mobile app provides even more features. If your business and personal accounts are combined, you can swipe left or right on the mobile app to separate business and personal expenses. And if you turn on automatic mileage tracking, the app records the number of miles traveled every time you drive, listing trips as business or personal later.

QuickBooks Self-Employed Pricing: $10 per month for the basic version; $17/month for a version that includes exporting data to TurboTax and covers the cost of federal and state tax filing.

FreshBooks

Best for freelancers with complex billing needs and multiple products or services to sell

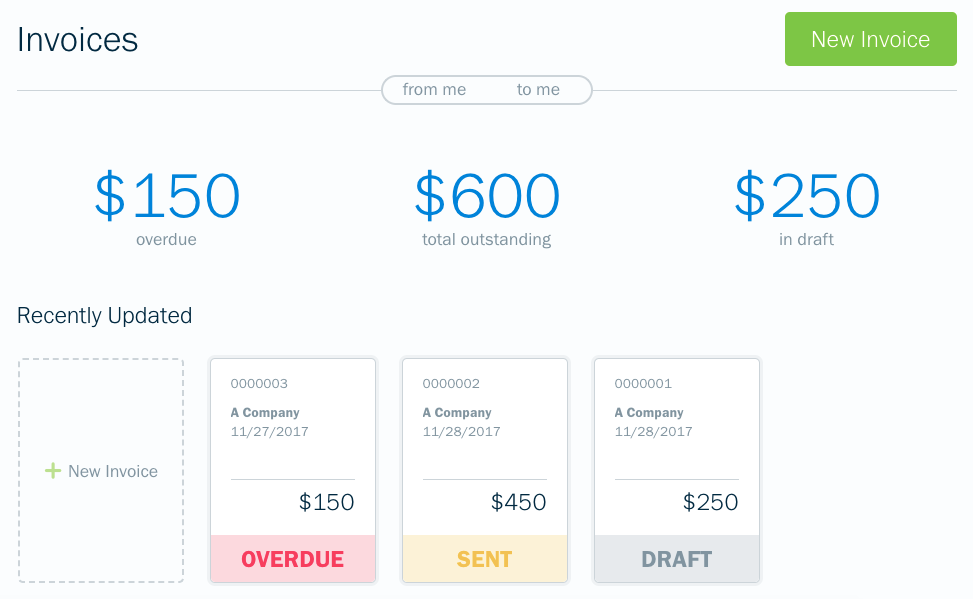

For some freelancers, billing is relatively simple: You agree on rates, and the client pays those rates each month. But for others, billing clients is much more complicated. Maybe you charge by the hour and keep track of billable time. Maybe you pay for things out of pocket and get reimbursed later. Maybe you're a writer and get paid by the word. Or maybe you hire and pay other contractors to help with clients.

If you have varying invoice needs, FreshBooks is designed for you. Within the system, you can set up multiple clients and multiple projects for each client. If you have clients that are notorious for paying late, you can set up automated payment reminders in Freshbooks that remind clients of upcoming and past due dates so you don’t have to.

FreshBooks covers nearly every use case for self-employed bookkeeping. It allows you to track time, record general business and billable expenses, send invoices, and collect payments.

FreshBooks Pricing: $15 per month for a single user and up to five active clients. Additional charges apply for more users or more than five active clients.

For a deeper look at FreshBooks, see our FreshBooks review.

See FreshBooks integrations on Zapier.

Wave

Best for a free invoice tracking tool that allows you to collect and track payments via PayPal

When you’re just starting out as a freelancer, you may not have a lot of excess cash to throw around. But even if you’re not making much, you still need to keep track of your income and expenses. Wave is a free solution that provides all the tools you need to do your business accounting—from sending professional invoices (including recurring invoices) to receipt scanning on the mobile app and even payroll processing.

Like QuickBooks and FreshBooks, Wave connects directly to your bank or credit card accounts, pulling in all of your transactions so you can easily capture business expenses. You can also upload old bank statements to the system to get caught up on past expenses you failed to record. This makes Wave handy if you neglected to do your accounting for part of the year.

You can not only create invoices in Wave but also accept direct credit card payments and bank transfers from clients. However, there is a small fee for accepting payments: 2.9% of the total + $0.30 for credit card payments and 1% for bank transfers). If you primarily accept payments through PayPal, use Wave’s simple integration to auto-populate your records with any payments accepted or sent through PayPal.

Wave Pricing: Free.

For a deeper look at Wave, see our Wave review.

See Wave integrations on Zapier.

FreeAgent

Best for freelancers who need a place to create, store, and track estimates

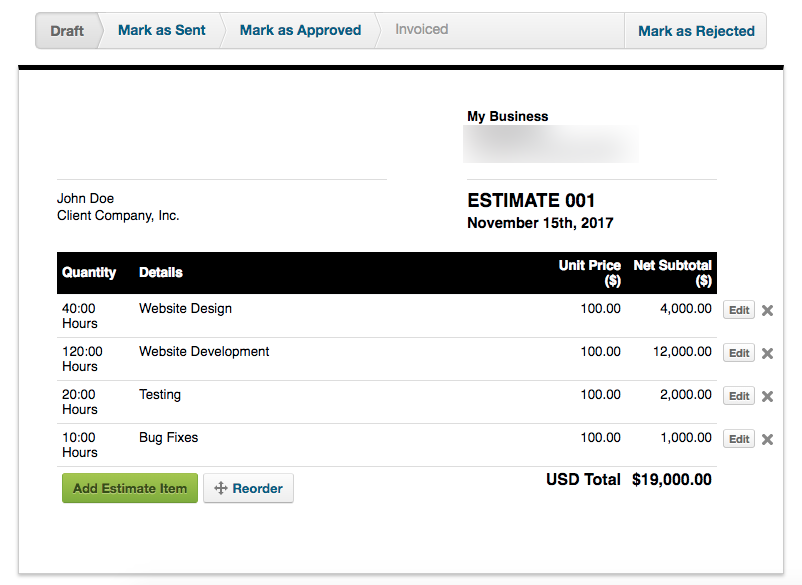

If you create estimates for large projects as part of your business, FreeAgent may be the right accounting app for you. Directly within the tool, you can create and send project estimates to prospective clients. If those prospects become clients later, track future invoicing against those estimates to see which of your contracts are profitable and which aren’t.

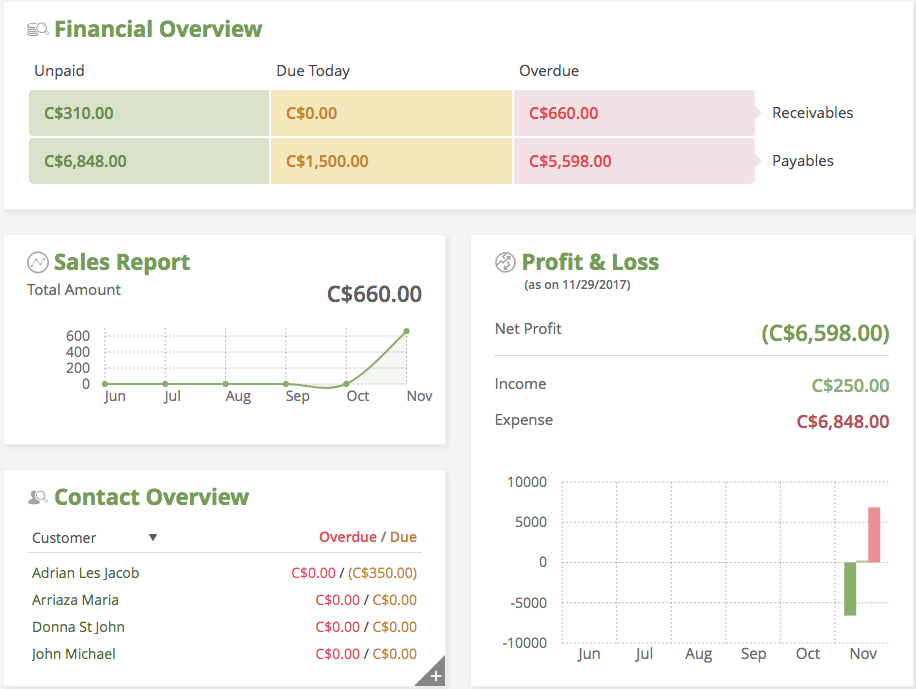

Additionally, including estimates as part of your bookkeeping records allows you to get a full picture of both your historical income and potential future profits. Quickly view both received and anticipated income on your FreeAgent dashboard to stay on top of the health of your freelancing business.

FreeAgent also has helpful bonus features like time tracking and invoicing. Like some of the other apps on this list, invoicing can be set up to send automatic payment reminders that nudge late-paying clients.

FreeAgent Pricing: $12 per month for the first six months; $24 per month thereafter. Discounted pricing is available if purchasing an annual subscription.

See FreeAgent integrations on Zapier.

Expensify

Best for freelancers who just want a way to keep track of expenses

If your accounting goal is just to have a way to keep track of your business receipts throughout the year so you can hand them off to your accountant during tax season, Expensify may be the best solution for you. Unlike the other apps on this list that offer more full-suite accounting solutions, Expensify focuses on a single goal: helping you keep track of your expenses.

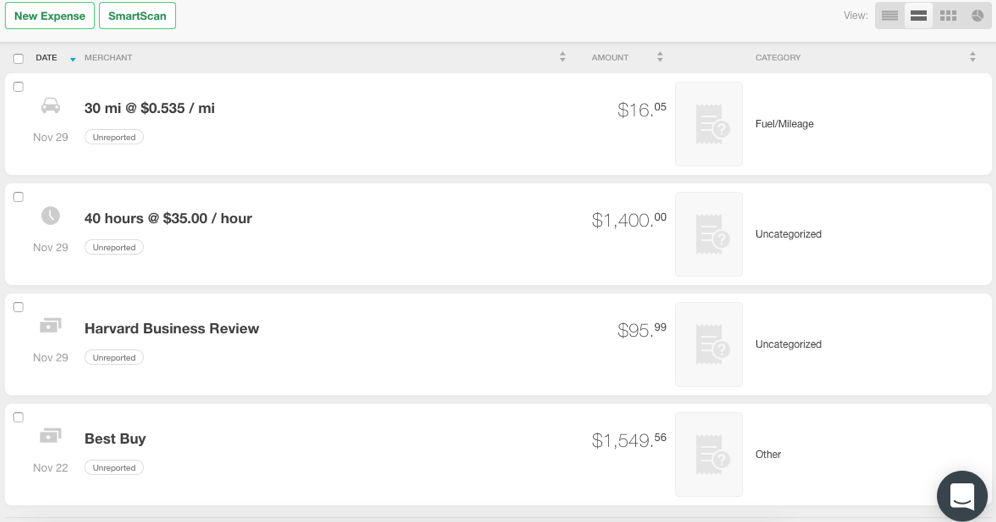

With Expensify’s mobile app, quickly capture clear images of receipts and the app will automatically categorize expenses, parse the amounts and merchant names, and save all the transaction details to your Expensify account. Add entries for mileage and hours worked, if needed, to track all of your business expenses in a single view. If you connect your credit card to Expensify, that's also an easy way to select expenses and turn them into emailable reports or PDF files.

Expensify is the simplest app on this list to use, but it doesn’t have some of the options that will help if you’re filing your taxes yourself—such as auto-calculations of quarterly taxes owed or categorizing expenses based on how you’ll file them as deductions. However, if you plan to work with an accountant, Expensify probably has all the features you need.

Expensify Pricing: Free for up to 10 SmartScans of receipts each month; from $5 per user/month for more scans

See Expensify integrations on Zapier.

SlickPie

Best for freelancers who need to invoice in multiple currencies

SlickPie has a steeper learning curve than some of the other apps on this list, but taking time to learn how it works is worth it if you need to create invoices in various currencies. Use SlickPie to create invoices in multiple currencies—even cryptocurrencies like Bitcoin and Ethereum—and accept payments both directly and through PayPal or Stripe.

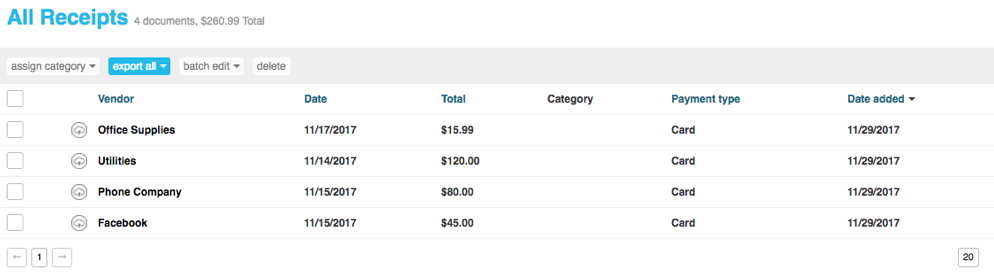

SlickPie also has a process for recording expenses from receipts, though it doesn’t use a mobile app like the other products on this list. Instead, you take a picture of a receipt—or a saved PDF of a bill—and drop it into a dedicated Dropbox folder. Then, SlickPie’s MagicBot technology processes the receipt data and adds it to the system for you.

SlickPie Pricing: Free for up to 100 receipts and 100 invoices per month; $9.95 for more than 100 receipts/invoices per month.

Shoeboxed

Best for simple receipt digitization

Another great option for freelancers who just want to hand off expenses and receipts to an accountant at the end of the year, Shoeboxed is a tool that makes it really simple to digitize all business receipts. Digitize receipts in many different ways:

- Capture pictures of receipts on the go with the Shoeboxed mobile app.

- Drag and drop files on your computer into the Shoeboxed Desktop Uploader.

- Forward email receipts to Shoeboxed.

- Set up auto-sync to have Shoeboxed automatically pull receipts from Gmail.

- Mail a pile of receipts to have them scanned and saved by Shoeboxed.

Because Shoeboxed offers so many different options for digitizing and saving receipts, you can record every business expense—regardless of how the receipt is delivered—within seconds. It’s particularly helpful if you have boxes or file folders filled with business receipts but no time to scan them in and want to outsource that job to a service.

Shoeboxed Pricing: $15 per month for one user and up to 50 documents per month. Higher-priced packages are also available for freelancers who need to digitize more than 50 expenses per month.

ZipBooks

Best for freelancers planning to grow their businesses into a larger company

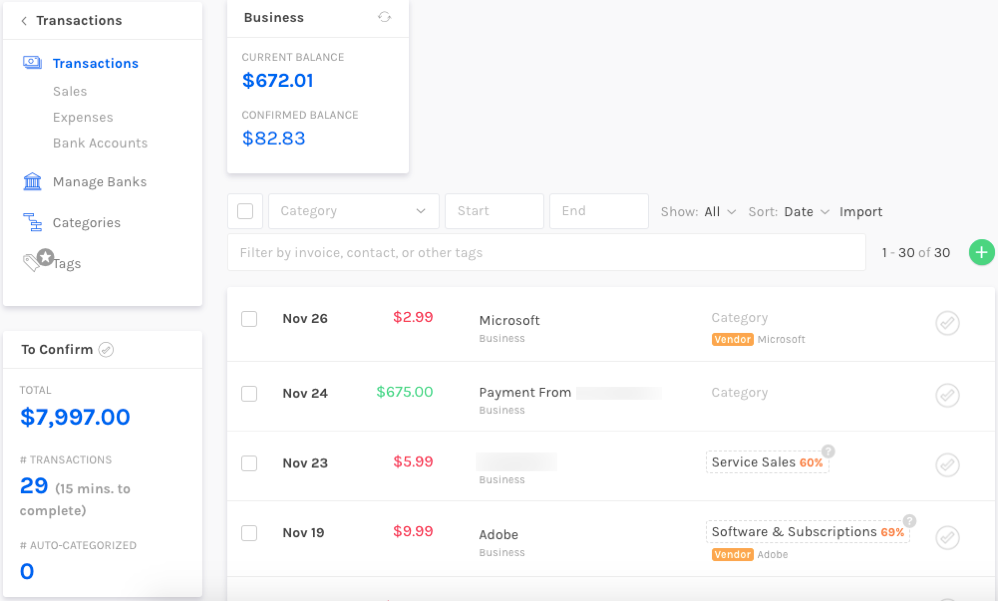

Like most of the apps on this list, ZipBooks allows freelancers to connect to a bank or credit card account, automatically pull transactions, and edit the details of those expenses. Use your phone to capture images of receipts, and upload them to ZipBooks using its mobile app.

ZipBooks also allows users to create and send invoices, and one of its standout features is recurring invoices. If you work on retainers or bill certain clients the same amount every month, set up recurring invoicing to have invoices automatically created and sent on your behalf. This keeps you from forgetting to send invoices and saves lots of time.

ZipBooks may also be a good choice for freelancers who are planning to grow their business. While the basic version is simple enough for one-person businesses, it can be expanded to include the things small businesses need, such as payroll and employee/contractor time-tracking. You can even upgrade to a plan that includes a personal bookkeeper.

ZipBooks Pricing: Free; from $15/month for recurring invoicing and unlimited bank connections

AND CO

Best for managing both accounting and legal tasks

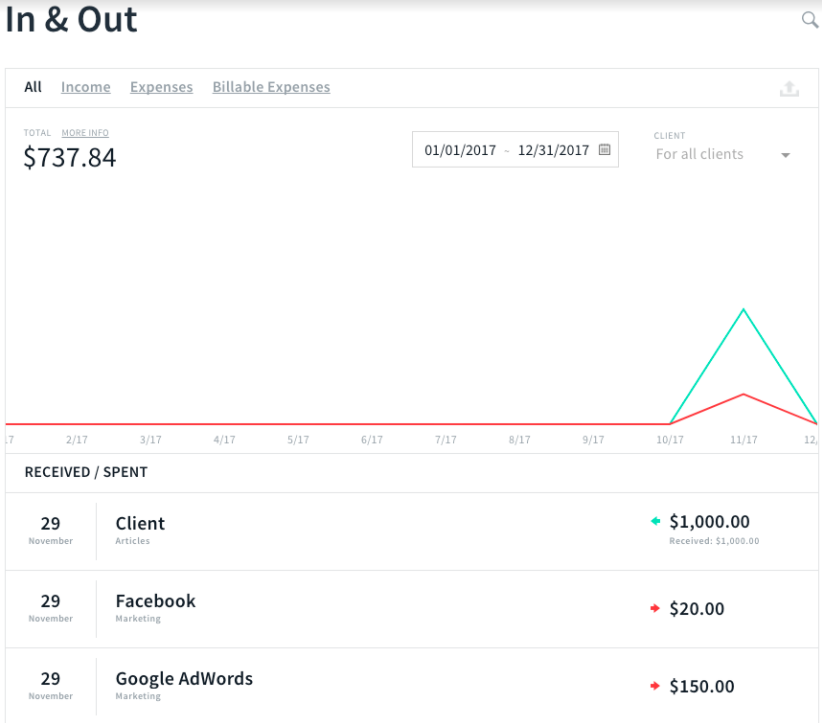

As far as accounting tasks go, AND CO has everything freelancers need. Connect your bank/credit accounts to record business expenses, track your time, create and send invoices, accept payments, and even see when clients have viewed invoices you sent. Forward email receipts or take a picture of physical receipts and upload them using AND CO’s mobile app.

Where AND CO stands out is with its legal features. Protect yourself with AND CO’s standard freelancing contracts, written by the Freelancers Union. Turn sections of the contract on and off as needed, and collect client signatures with e-signing functionality. And when clients don’t pay, send a prewritten physical demand letter directly from the app.

AND CO Pricing: Free for one contract per month and up to 20 recorded expenses per month; from $14/month for unlimited contracts and expense recording, prices start at $14 per month.

Stop Wasting Time and Start Automating Your Bookkeeping

Every hour you spend on bookkeeping, accounting, and tax-related tasks is an hour that you’re not earning any income. As much as possible, you’ll want to automate these tasks so you can focus on building your business and your profits. With Zapier’s app automations, you can build automated workflows that handle bookkeeping tasks so you don’t have to.

Here are some examples:

As Benjamin Franklin famously wrote: “in this world nothing can be said to be certain, except death and taxes.” Whether you track your expenses or not—pay your quarterly taxes or not—tax season will come every year without fail.

As a freelancer, you’re already stuck with the burden of paying your own self-employment taxes and health insurance premiums. Don’t suffer from the added burden of paying too much in taxes because of bad bookkeeping. Save yourself a lot of time and money by finding accounting software that works for you.

Title image by Freepik

source https://zapier.com/blog/accounting-bookkeeping-software-freelance/

Very good points you wrote here..Great stuff...I think you've made some truly interesting points.Keep up the good work. invoicing

ReplyDelete